Loading

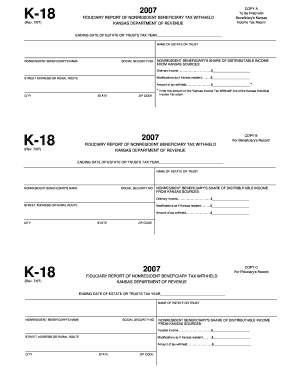

Get Fiduciary Report For Nonresident Beneficiary Tax Withheld (k - Ksrevenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fiduciary Report For Nonresident Beneficiary Tax Withheld (K - Ksrevenue online

Filling out the Fiduciary Report For Nonresident Beneficiary Tax Withheld is essential for ensuring accurate tax reporting by estates or trusts with nonresident beneficiaries. This guide provides clear and supportive instructions to help you navigate the form efficiently.

Follow the steps to accurately complete your tax report.

- Use the 'Get Form' button to access and open the fiduciary report in your editor.

- Enter the ending date of the estate or trust's tax year in the specified field.

- Fill in the name of the estate or trust in the provided space.

- Complete the nonresident beneficiary’s name field accurately.

- Input the social security number of the nonresident beneficiary in the designated area.

- Indicate the beneficiary’s share of distributable income from Kansas sources by entering the ordinary income amount.

- Include any modifications as if the beneficiary were a Kansas resident.

- Enter the total amount of tax withheld in the appropriate section.

- Make sure to fill out the beneficiary’s complete address, including street address, city, state, and zip code.

- Review all entered information for accuracy before finalizing the document.

- Once complete, you can choose to save changes, download, print, or share the completed form.

Complete your fiduciary documents online to ensure compliance and accuracy.

Fiduciary income taxation is really the income taxation of estates and trusts and that should be contrasted with the estate tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.