Loading

Get 2007_formeqc_front.ai

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007_FormEQC_front.ai online

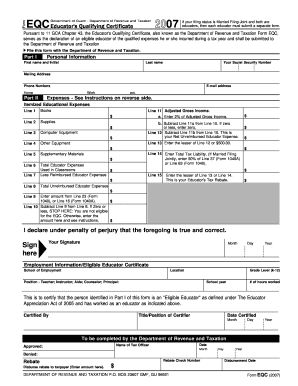

This guide provides clear and detailed instructions on completing the 2007_FormEQC_front.ai online. Whether you are a seasoned educator or filling out this form for the first time, the following steps will support you in accurately reporting your educational expenses.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to obtain the form and access it in your online editing tool.

- In Part I, enter your personal information including your first name, last name, Social Security number, mailing address, and phone numbers (home and work). Make sure your contact information is accurate and current.

- Proceed to Part II, where you will itemize your educational expenses. Begin with Line 1, entering the amount spent on books. Follow the same format for Lines 2 through 5 for other expenses such as supplies, computer equipment, and supplementary materials.

- Complete Line 6 by adding all the amounts from Lines 1 to 5 to calculate your total qualified educator expenses used in the classroom.

- If you received any reimbursements, input that amount in Line 7. Then, in Line 8, determine your total unreimbursed educator expenses by subtracting Line 7 from Line 6.

- On Line 9, report the amount claimed on Form 1040, Line 23, or Form 1040A, Line 16. Then, in Line 10, subtract Line 9 from Line 8. If the result is zero or less, you will stop here as you are not eligible for the educator's tax rebate.

- If you are eligible, continue to complete Line 11. In Line 11a, calculate 2% of your adjusted gross income and enter that value. For Line 11b, subtract Line 11a from Line 10.

- Proceed to Line 12 and Line 13 where necessary calculations will be made. Enter the lesser amount from Line 13 or Line 14 on Line 15. This final amount represents your educator's tax rebate.

- In the certification section, provide your signature along with the date. Ensure that you have a certifier from your school complete their section, confirming your eligible educator status for the tax year.

- Finally, review all entries for accuracy. Once confirmed, you may save your changes, download, print, or share the completed form as necessary.

Complete your documents online with confidence and ensure you receive the benefits you are entitled to.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.