Loading

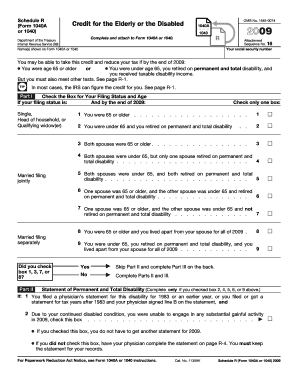

Get 2009 Form 1040a Or 1040 (schedule R). Credit For The Elderly Or The Disabled

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2009 Form 1040A Or 1040 (Schedule R). Credit For The Elderly Or The Disabled online

This guide provides comprehensive instructions on how to complete the 2009 Form 1040A or 1040 (Schedule R) for the Credit for the Elderly or the Disabled online. By following these steps, you can navigate the form with confidence and ensure that you take advantage of any credits available to you.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Identify your filing status by checking the appropriate box in Part I. You must indicate your status and age as of the end of 2009, whether you are single, married, or head of household.

- Complete Part II if you selected specific boxes in Part I that pertain to your disability status. If required, have your physician complete the statement indicating your permanent and total disability.

- In Part III, calculate your credit by locating the amounts corresponding to your selected boxes from Part I. Enter the amounts as directed—either $5,000 or $7,500, depending on your situation.

- Follow the instructions to complete lines 10 through 23, ensuring to account for any nontaxable income received. This will help determine your eligibility for the credit.

- Once all calculations and entries are complete, enter the final credit value on Form 1040A or Form 1040 as instructed.

- After finalizing your form, you can save your changes, download, print, or share the completed form as needed.

Start filling out your 2009 Form 1040A Or 1040 (Schedule R) online today to ensure you receive the credits you may qualify for.

This schedule is used by all taxpayers who are required to apportion business income. Special instructions apply to individuals, partnerships and limited liability companies (LLCs).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.