Loading

Get Balance Due Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Balance Due Information online

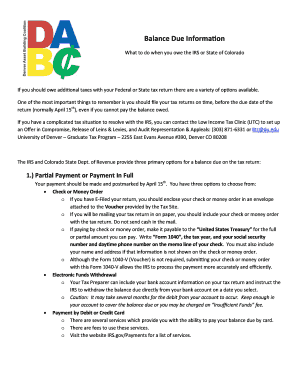

Filling out the Balance Due Information form is essential for managing your tax obligations with the IRS or the State of Colorado. This guide will provide you with step-by-step instructions to accurately complete the form online.

Follow the steps to complete the Balance Due Information form effectively.

- Press the ‘Get Form’ button to access the Balance Due Information form and open it in your preferred online editor.

- Begin by reviewing the introductory instructions provided within the form. Understand the options available for managing any outstanding balance due.

- Fill in your personal information in the designated fields. This includes your name, address, and contact details. Ensure that all information is accurate and matches your tax profile.

- Indicate the tax year and related forms if applicable. This helps to identify the tax obligation you are addressing.

- Select your preferred payment method from the options available: Check or Money Order, Electronic Funds Withdrawal, or Payment by Debit or Credit Card. Each method has specific instructions that you will need to follow.

- If you opt for an Installment Agreement, complete the necessary fields to indicate your proposed payment plan. Be aware of any associated fees that might apply.

- If making voluntary payments, ensure you write the appropriate information on the memo line including the tax year and your social security number as instructed.

- Review all entered information carefully for accuracy. Make any necessary corrections before finalizing your submission.

- Once satisfied with the details, choose to save changes, download the completed form for your records, or print it for submission. If sharing is required, use the available options to do so.

Complete your Balance Due Information form online today to stay on top of your tax obligations.

Also, your proposed payment amount must full pay the assessed tax liability within 72 months or satisfy the tax liability in full by the Collection Statute Expiration Date (CSED), whichever is less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.