Loading

Get Joint With Access To The Account After Death Of One Or More Parties

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Joint With Access To The Account After Death Of One Or More Parties online

Filling out the Joint With Access To The Account After Death Of One Or More Parties form can seem daunting, but it is crucial for managing account access after the death of one or more account holders. This guide provides a detailed, step-by-step approach to ensure you can complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Begin by clicking the ‘Get Form’ button to obtain the Joint With Access To The Account After Death Of One Or More Parties form and open it in your preferred online editor.

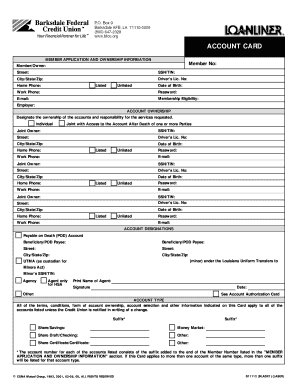

- In the first section, fill in your member number along with your personal information such as your full name, address, Social Security Number (SSN) or Tax Identification Number (TIN), driver's license number, date of birth, and contact details including home and work phone numbers.

- Designate the type of account ownership. Select ‘Joint with Access to the Account After Death of one or more Parties’ to specify that multiple individuals have access.

- For each joint owner, provide their personal details, including their name, SSN/TIN, address, driver's license number, date of birth, and contact details. If there are multiple joint owners, ensure to repeat this section for each individual.

- Complete the Account Designations section by entering the name and details of any beneficiaries, specifically for Payable on Death (POD) designations.

- If applicable, fill in details for any minors under guardianship by designating them under the Louisiana Uniform Transfers to Minors Act, including their SSN/TIN.

- In the Account Type section, check all relevant account types that apply to you, such as Share/Savings, Money Market, and more, ensuring to indicate any suffixes corresponding to the member number.

- Fill out additional account services if needed, such as Payroll Deduction, ATM Card, or Internet Banking to customize your account services.

- Designate a life savings beneficiary if applicable by providing their name, SSN/TIN, date of birth, and address.

- Review the TIN certification section and affirm the accuracy of the information provided, ensuring to cross out applicable statements if they do not apply to you.

- In the Authorization section, all parties should sign and date the document to indicate their agreement to the terms and conditions provided in the accompanying agreements.

- Once you have completed the form, ensure to save any changes made, and consider downloading, printing, or sharing the form as needed.

Complete your documents online today for a hassle-free experience.

Joint bank account holders generally have the right of survivorship, which grants the surviving account holder ownership of the entire account balance. The surviving account holder retains ownership regardless of which owner contributed the money, and the account doesn't go through the probate process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.