Loading

Get Apply The Proceeds To Any Unpaid Portion Of The Tax Deferred By Reason Of The Election And Any

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Apply The Proceeds To Any Unpaid Portion Of The Tax Deferred By Reason Of The Election And Any online

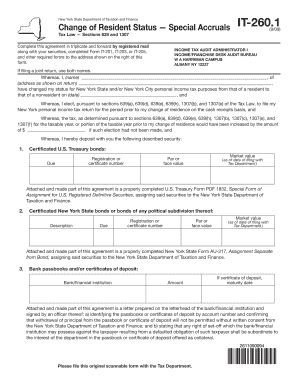

Completing the form 'Apply The Proceeds To Any Unpaid Portion Of The Tax Deferred By Reason Of The Election And Any' is essential for users who have changed their residency status and need to manage their tax obligations effectively. This guide provides a step-by-step approach to help you accurately fill out the form online.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering your name in the designated field, as required.

- Provide your current address as shown on your tax return in the appropriate section.

- Indicate the date you changed your residence status in the specified area of the form.

- Follow the instructions to elect to file your New York personal income tax return on a cash receipts basis.

- Complete the section detailing any securities being deposited, including the type and market value.

- If applicable, provide information related to bank passbooks or certificates of deposit and include supporting documents.

- Review the agreement statements and check the boxes to confirm your understanding and agreements.

- Sign and date the form at the bottom. If filing jointly, include your partner's signature.

- After completing the form, save your changes and choose to download, print, or share the document as needed.

Start completing your forms online to manage your tax obligations efficiently.

What does tax-deferred mean? Tax-deferred means you don't pay taxes until you withdraw your funds, instead of paying them upfront when you make contributions. With tax-deferred accounts, your contributions are typically deductible now, and you'll only pay applicable taxes on the money you withdraw in retirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.