Loading

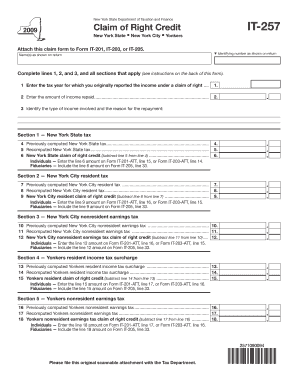

Get Complete Lines 1, 2, And 3, And All Sections That Apply (see Instructions On The Back Of - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Complete Lines 1, 2, And 3, And All Sections That Apply (see Instructions On The Back Of - Tax Ny online

Filling out the Complete Lines 1, 2, and 3, as well as all applicable sections of the Tax Ny form, is an essential step in claiming your right credit. This guide will provide you with a clear, step-by-step approach to ensure you complete the form accurately and effectively.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with line 1 by entering the tax year for which you originally reported the income under a claim of right. Ensure accuracy in this date as it is crucial for your claim.

- On line 2, provide the amount of income that you repaid. This value should directly reflect what you returned to correct the previous income report.

- Complete line 3 by identifying the type of income involved and the reason for the repayment. This helps clarify your situation and supports your claim.

- Proceed to Section 1 and enter the previously computed New York State tax on line 4, as well as the recomputed tax on line 5. Calculate the New York State claim of right credit by subtracting line 5 from line 4 on line 6.

- If applicable, continue to Section 2. Enter the previously computed New York City resident tax on line 7, then provide the recomputed tax on line 8 and find the claim of right credit by completing line 9.

- For Section 3, record the previously computed New York City nonresident earnings tax on line 10 and the recomputed amount on line 11 to determine the claim of right credit on line 12.

- In Section 4, repeat the process for Yonkers by filling in the previously computed tax on line 13, the recomputed surcharge on line 14, and calculating the credit on line 15.

- Finally, complete Section 5 with the previously computed Yonkers nonresident earnings tax on line 16 and the recomputed amount on line 17 to quantify the claim of right credit on line 18.

- Once all applicable sections are filled, review the form for accuracy, save your changes, and then download, print, or share the completed form as necessary.

Submit your completed documents online to ensure you receive your claim of right credit promptly.

Line 19a: Recomputed federal adjusted gross income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.