Loading

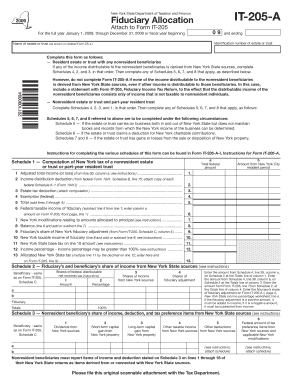

Get For The Full Year January 1, 2009, Through December 31, 2009 Or Fiscal Year Beginning And Ending

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For The Full Year January 1, 2009, Through December 31, 2009 Or Fiscal Year Beginning And Ending online

Filling out the For The Full Year January 1, 2009, Through December 31, 2009 Or Fiscal Year Beginning And Ending form requires attention to specific details and accurate information. This guide provides clear and supportive steps to help users effectively complete the form online.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identification number of the estate or trust in the designated field. Make sure to double-check this number for accuracy.

- Input the name of the estate or trust as shown on federal Form SS-4, ensuring that the name is spelled correctly and match the federal document.

- Determine if the estate or trust is a resident estate or trust with any nonresident beneficiaries. If applicable, proceed to complete Schedules 4, 2, and 3 sequentially, as instructed.

- If you are dealing with a nonresident estate or trust and a part-year resident trust, fill out Schedules 4, 2, 3, and 1 in that exact order, followed by any relevant Schedules 5, 6, 7, and 8.

- For completing Schedule 1, start with computing your adjusted total income or loss, then calculate the income distribution deduction based on federal Form 1041, and proceed accordingly through the schedule's various lines.

- Make a note of the percentages applicable to any New York modifications in Schedule 2, specifically in relation to the shares of income from New York sources and the fiduciary's adjustment.

- As you fill out Schedule 3, ensure that all nonresident beneficiary shares of income, deductions, and tax preferences are accurately reported from New York State sources.

- Continue with Schedules 4 through 8 as outlined in the instructions, paying close attention to the specific types of income and deductions that each schedule addresses.

- Once all necessary fields have been filled, save any changes you have made, then download, print, or share the completed form as needed.

Complete your documents online today to ensure accuracy and compliance with filing requirements.

If your fiscal year ends on December 31, you're using a calendar year as your business tax year. Your business fiscal year is almost always your tax year, but it doesn't have to be. A corporation with a March 31 fiscal year-end may also file a corporate income tax return, effective March 31.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.