Loading

Get 2007 Form 2210-f (fill-in Capable). Underpayment Of Estimated Tax By Farmers And Fishermen

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form 2210-F (Fill-In Capable). Underpayment Of Estimated Tax By Farmers And Fishermen online

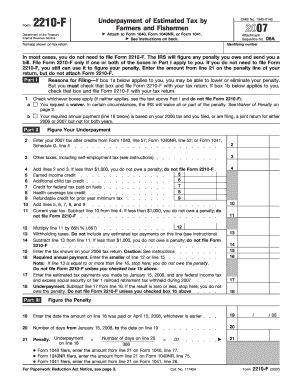

Filling out the 2007 Form 2210-F is crucial for farmers and fishermen who might be facing penalties for underpaying estimated taxes. This guide provides clear, step-by-step instructions on how to complete the form accurately and effectively.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to acquire the form and open it in your preferred editing application.

- Identify the name(s) shown on your tax return and enter them in the designated space on the form.

- Provide your identifying number in accordance with your tax return instructions.

- Determine if you need to file the form by checking the boxes in Part I. If applicable, check the appropriate box that reflects your situation.

- In Part II, begin to calculate your underpayment. Start by entering your 2007 tax amount after credits from the relevant line of Form 1040, Form 1040NR, or Form 1041.

- Add any other taxes incurred, including self-employment tax, on line 2.

- Combine the amounts from lines 2 and 3. If the total is less than $1,000, you do not owe a penalty and should not file Form 2210-F.

- List any applicable credits in lines 5 through 9, adding them together on line 10.

- Subtract the total credits on line 10 from the total tax on line 4 to determine your current year tax.

- Calculate your required annual payment by entering the smaller of line 12 or line 15 on line 16.

- Document any tax payments you made up until January 15, 2008, on line 17.

- Subtract line 17 from line 16 to find your underpayment amount. If this result is zero or less, you do not owe a penalty and should not file the form.

- In Part III, calculate the penalty by entering the date the amount on line 18 was paid or April 15, 2008, whichever is earlier, on line 19.

- Determine the number of days between January 15, 2008, and the date on line 19 to complete line 20.

- Calculate the penalty amount for underpayment on line 21 and ensure you include it appropriately in your tax filings.

- Review all entries for accuracy, then save, download, print, or share your completed Form 2210-F as required.

Complete your tax documents online for a smoother filing process.

The Underpayment of Estimated Tax by Individuals Penalty applies to individuals, estates and trusts if you don't pay enough estimated tax on your income or you pay it late. The penalty may apply even if we owe you a refund. Find how to figure and pay estimated tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.