Loading

Get La Dor R-210r 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-210R online

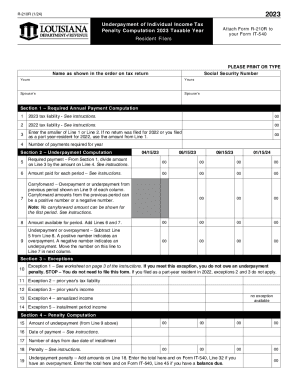

The LA DoR R-210R form is essential for calculating any penalties related to the underpayment of individual income tax for the 2023 taxable year. This guide will provide you with clear, step-by-step instructions to confidently complete and submit this form online.

Follow the steps to fill out the LA DoR R-210R with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with providing your name and Social Security number in the designated fields as shown on your tax return. Ensure that the information is entered accurately.

- Move to Section 1 and calculate your required annual payment. Start by entering your 2023 tax liability on Line 1 and your 2022 tax liability on Line 2. Next, enter the smaller amount from Lines 1 or 2 on Line 3.

- Enter the number of payments required for the year on Line 4. This will be used to compute the required payments.

- Proceed to Section 2. Calculate the required payment by dividing the amount from Line 3 by the number on Line 4. Input this amount on Line 5.

- On Lines 6 to 9, for each payment period, enter the amount paid, any carryforward amounts, and calculate the underpayment or overpayment for each period accordingly.

- In Section 3, carefully review the exceptions listed. If any apply, follow the instructions provided to determine if you need to file this form.

- In Section 4, if there is any underpayment, complete the calculations by entering the details as directed for the amounts due, payment dates, and penalties.

- Review all entered information for accuracy and completeness. Save your changes.

- Finally, download, print, or share the form as required for your submission.

Start completing your LA DoR R-210R online today to ensure timely and accurate filing.

Minimum Gross Income Thresholds for Taxes Single and under age 65: $12,950. Single and age 65 or older: $14,700. Married filing jointly and both spouses are under age 65: $25,900. Married filing jointly and one spouse is age 65 or older: $27,300. Married filing jointly and both spouses are age 65 or older: $28,700.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.