Loading

Get La Dor R-8453f 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-8453F online

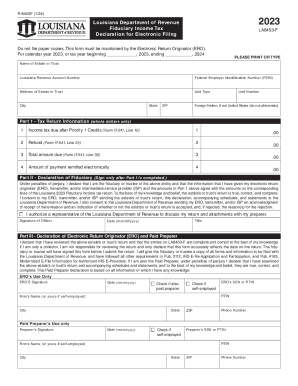

This guide will assist users in completing the LA DoR R-8453F form efficiently and accurately online. The LA DoR R-8453F is a declaration for electronic filing, specifically for fiduciary income tax.

Follow the steps to complete the LA DoR R-8453F online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the form by entering the name of the estate or trust in the designated field. Ensure that this section is completed accurately, as this will identify the entity for which the form is being filed.

- Provide the Louisiana revenue account number. This is critical for tracking the entity’s filings with the Louisiana Department of Revenue.

- Enter the federal employer identification number (FEIN) in the respective field. This number is essential for federal tax reporting.

- Complete the address section, including the address of the estate or trust, unit type, city, state, ZIP code, and unit number, if applicable.

- In Part I, provide the necessary monetary values in whole dollars only. Fill out the income tax due after priority 1 credits as instructed, followed by the refund and total amounts due.

- If applicable, indicate the amount of payment remitted electronically in the designated field.

- Proceed to Part II and sign the declaration only after completing Part I. This declaration indicates agreement with the information provided and authorizes transmission of the return.

- In Part III, ensure that the appropriate signatures from the electronic return originator and, if applicable, the paid preparer, are obtained. Fill in their respective titles and the dates accurately.

- Review all entries for accuracy before finalizing your form. Once satisfied, you can save changes, download, print, or share the LA DoR R-8453F form as needed.

Complete your documents online today for a streamlined filing experience.

Related links form

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.