Loading

Get Ky 740-v 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 740-V online

Filling out the KY 740-V, Kentucky Individual Payment Voucher, is a crucial step for individuals who owe taxes on their electronically filed income tax returns. This guide provides clear, step-by-step instructions to help you complete the form accurately.

Follow the steps to complete your KY 740-V online.

- Press the ‘Get Form’ button to access the form and open it in your editing platform.

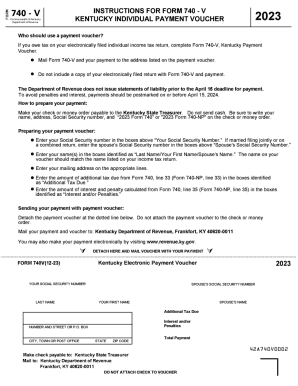

- Enter your Social Security number in the boxes labeled 'Your Social Security Number.' If you are filing jointly, enter your spouse's Social Security number in the boxes identified as 'Spouse’s Social Security Number.'

- Input your name(s) in the fields marked 'Last Name/Your First Name/Spouse’s Name.' Ensure that the name(s) you enter match the information on your income tax return.

- Fill in your mailing address in the appropriate lines provided on the form.

- Enter the amount of additional tax due from your Form 740, line 33 (or from Form 740-NP, line 33) in the boxes marked 'Additional Tax Due.'

- Input the amount of interest and penalties calculated from Form 740, line 35 (or from Form 740-NP, line 35) in the boxes labeled 'Interest and/or Penalties.'

- Detach the payment voucher at the indicated dotted line. It is important not to attach the voucher to your check or money order.

- Mail your completed payment voucher along with your payment to: Kentucky Department of Revenue, Frankfort, KY 40620-0011. Alternatively, you have the option to make your payment electronically.

- After reviewing the information for accuracy, save your changes, download a copy of the form, or print it for your records.

Complete your KY 740-V online to ensure a smooth tax payment process.

Filing electronically is the fastest way to receive your refund. Electronically filed returns generally process within two to three weeks. Only refunds from electronically-filed returns can be direct deposited into your bank account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.