Loading

Get Remote Deposit Services Application Page 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Remote Deposit Services Application PAGE 1 online

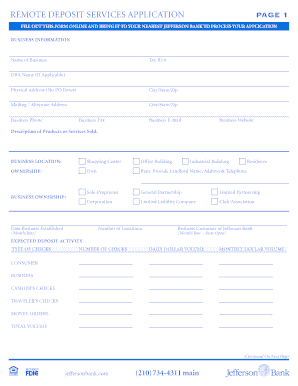

Filling out the Remote Deposit Services Application PAGE 1 online is an important step for businesses seeking to utilize remote deposit services. This guide offers clear, step-by-step instructions to ensure you complete the application correctly and efficiently.

Follow the steps to successfully complete the application.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the business information section. You will need to provide the name of your business, tax ID number, and any doing business as (DBA) name if applicable. Ensure to include the physical address—do not use P.O. Boxes—as well as the city, state, and zip code.

- Input the mailing address if it is different from the physical address provided. Include the city, state, and zip code here as well.

- Provide contact details including your business phone number, fax number, email address, and the website of your business.

- Describe the products or services your business offers in the designated field.

- Specify the type of business location—options include shopping center, office building, industrial building, residence, etc.

- Indicate the ownership structure of your business by choosing among options like own, rent, sole-proprietor, general partnership, limited partnership, corporation, limited liability company, or club/association. If renting, provide the landlord's name, address, and telephone number.

- Enter the date your business was established and the number of locations it operates. The date should be in month/year format.

- Record your business banking relationship with Jefferson Bank, specifying the date opened in month/year format.

- Forecast your expected deposit activity by indicating the types of checks you will be processing (e.g., consumer checks, business checks, cashier’s checks, traveler’s checks, money orders), the number of checks anticipated, and the daily and monthly dollar volumes for each category.

- Review all the information entered to ensure accuracy and completeness before concluding the form.

- Once you have filled out the form, you can save changes, download, print, or share the completed application as required.

Get started on completing your Remote Deposit Services Application online today.

Related links form

1:16 3:28 How to Endorse a Check for Mobile Deposit | Money Instructor - YouTube YouTube Start of suggested clip End of suggested clip And it can cause some delays. Right under your signature write for mobile deposit. Only this ensuresMoreAnd it can cause some delays. Right under your signature write for mobile deposit. Only this ensures that the check can only be deposited by a mobile deposit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.