Loading

Get 'i I -a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 'I I -A online

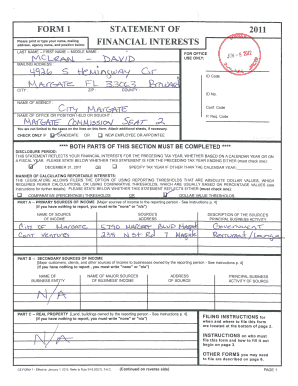

Filling out the 'I I -A form is an essential step in disclosing your financial interests. This guide will help you navigate the form efficiently and accurately, ensuring that you complete each section correctly.

Follow the steps to fill out the 'I I -A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your last name, first name, and middle name in the designated fields. Ensure that you provide accurate details as requested.

- Next, input your mailing address, including street address, city, county, and ZIP code. Double-check for accuracy to avoid any issues with correspondence.

- Identify your agency name and your position held or sought. Clearly stating this information is crucial for proper filing.

- Complete the disclosure period section. Indicate whether this statement is for the preceding tax year ending on December 31 or specify another tax year if applicable.

- In the manner of calculating reportable interests section, choose between comparative (percentage) thresholds or dollar value thresholds, making sure to understand the implications of each choice.

- Proceed to Part A, where you will report your primary sources of income. List the name of the income source, their address, and the principal business activity. If no income is reportable, write 'none' or 'n/a'.

- In Part B, disclose any secondary sources of income related to businesses you own. Include relevant details consistent with the previous section.

- Continue with Part C, which requires you to report any real property owned. Follow the same procedure for disclosure.

- Part D asks for intangible personal properties, such as stocks and bonds. Ensure accuracy when providing this information.

- In Part E, disclose any major liabilities you have. List creditor names and addresses, while adhering to the same reporting style.

- Complete Part F by providing information on your interests in specified businesses. Clearly indicate your ownership percentage and the nature of your ownership.

- After all sections are completed, sign and date the form. Ensure you have filled out all mandatory fields and attached any additional sheets if needed.

- Finally, save your changes, download, print, or share the completed form as necessary for submission according to filing instructions.

Complete your forms online today for a streamlined experience.

Functions. TFIIA interacts with the TBP subunit of TFIID and aids in the binding of TBP to TATA-box containing promoter DNA. Interaction of TFIIA with TBP facilitates formation of and stabilizes the preinitiation complex.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.