Loading

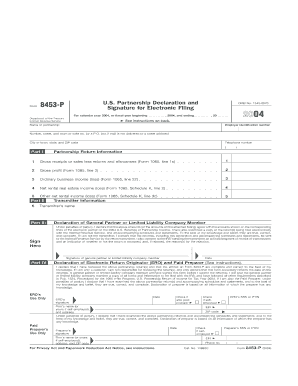

Get 2004 Form 8453-p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 Form 8453-P online

Filling out the 2004 Form 8453-P online is a crucial step for partnerships submitting an electronic income tax return. This guide will provide you with comprehensive instructions to ensure a smooth and accurate filing process.

Follow the steps to complete the 2004 Form 8453-P online effectively

- Press the ‘Get Form’ button to obtain the form and open it in the form editor.

- Begin by entering the name of the partnership in the designated field.

- Input the employer identification number (EIN) accurately in the specified area.

- Fill in the number, street, and room or suite number (or P.O. box if applicable) correctly.

- Complete the city or town, state, and ZIP code fields with accurate information.

- Enter the partnership's telephone number in the provided space.

- Proceed to Part I and fill in the gross receipts or sales less returns and allowances (line 1). Ensure this is the amount from Form 1065, line 1c.

- Document the gross profit by entering the information from Form 1065, line 3 in the gross profit field (line 2).

- Record the ordinary business income or loss from Form 1065, line 22 into the corresponding field (line 3).

- For line 4, input the net rental real estate income or loss, sourced from Form 1065, Schedule K, line 2.

- Fill line 5 with the other net rental income or loss based on Form 1065, Schedule K, line 3c.

- Move to Part II and enter the transmitter's name as required.

- In Part III, the designated general partner or member of the limited liability company must sign the declaration on the appropriate line.

- Make sure to include the date next to the signature of the general partner or limited liability company member.

- If applicable, the Electronic Return Originator must sign in Part IV, noting the date.

- Complete the fields for the ERO's SSN or PTIN, firm name, and address if applicable.

- Once all fields are complete and accurate, save your changes, and download or print the form for your records.

Start completing your documents online today!

The form 8453 is used to allow the preparer to mail documents to the IRS; However, the form 8879 will still be generated and will need to be signed and retained for three (3) years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.