Loading

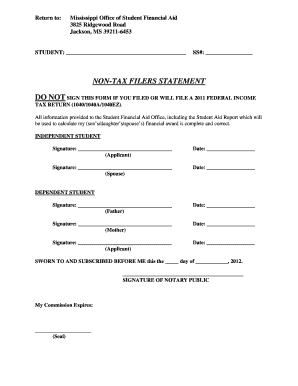

Get Ms Non-tax Filers Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS Non-Tax Filers Statement online

Completing the MS Non-Tax Filers Statement is an important step for individuals who are not required to file a federal income tax return. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring your application is accurate and complete.

Follow the steps to complete the MS Non-Tax Filers Statement online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the student’s name in the designated field labeled 'STUDENT'. Ensure that your full name is clearly stated.

- Enter the Social Security number (SS#) in the provided space, ensuring accuracy to avoid processing delays.

- Make sure to read the instruction stating that you should not sign the form if you filed or will file a 2011 federal income tax return.

- Accurately complete the statement confirming that all information provided is correct regarding the financial aid calculation.

- If you are an independent student, sign and date the form where indicated. Ensure that you include the date beside your signature.

- If applicable, have your spouse sign and date the form in the specified area.

- If you are a dependent student, both parents should sign and date the form in their respective sections.

- Finally, sign and date the form in the applicant section to confirm your acknowledgment.

- After completing all sections of the form, review for accuracy and completeness. You may then save your changes, download, print, or share the form as needed.

Ensure your financial aid application is complete by filling out the MS Non-Tax Filers Statement online today.

Yes, the IRS will likely send you a letter if you do not file your taxes. This letter typically addresses your filing status and any steps you need to take next. Having a MS Non-Tax Filers Statement can help clarify your situation, especially when responding to IRS communications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.