Loading

Get 2011 Int -3 - Missouri Department Of Revenue - Dor Mo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 INT -3 - Missouri Department Of Revenue - Dor Mo online

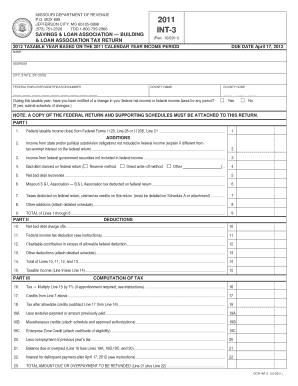

This guide provides a detailed, step-by-step approach to completing the 2011 INT -3 form from the Missouri Department of Revenue. Designed for users with varying levels of experience, it offers clear instructions to facilitate a seamless filing process.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to acquire the 2011 INT -3 form and open it in your preferred editor.

- Begin by entering your name in the designated field, ensuring it reflects the full legal name of the entity filing.

- Complete the address section accurately, including the city, state, and ZIP code. Ensure this information matches official records.

- Input the federal employer identification number in the provided field; this is essential for tax identification purposes.

- Indicate the county name and county code as required for your specific location.

- Answer the question regarding any changes in your federal net income or taxes. Select 'Yes' if you have been notified; be prepared to submit a schedule of changes if applicable.

- Proceed to Part I and record your federal taxable income from the relevant federal forms on Line 1.

- Complete the Additions section (Lines 2-8) by listing any income or deductions that are not included in federal income, referencing the specific accompanying details requested.

- In Part II, provide deductions on Lines 10-13, using accurate amounts based on your records.

- Calculate total deductions and record the result on Line 14.

- Determine your taxable income by subtracting total deductions (Line 14) from federal taxable income (Line 9) and document the result on Line 15.

- In Part III, calculate the tax amount based on taxable income and apply any credits as indicated on Lines 16-18.

- Fill in any additional relevant financial information and review all calculations for accuracy.

- Finalize your document by including the required signatures in the authorization section, and ensure that all preparer’s information is complete.

- Once reviewed, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your documents online today for a smoother filing experience.

Wayne Wallingford currently serves as Director of the Department of Revenue. Learn more about Director Wallingford.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.