Loading

Get State And Local Tax Weekly For October 27 And November 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State And Local Tax Weekly For October 27 And November 3 online

This guide provides clear instructions for users on how to accurately fill out the State And Local Tax Weekly For October 27 And November 3 online. By following these steps, you will be able to complete the form efficiently and correctly.

Follow the steps to complete your tax form online

- Click 'Get Form' button to access the State And Local Tax Weekly For October 27 And November 3 online.

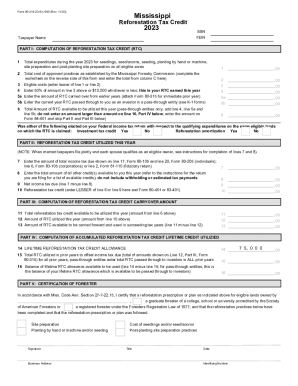

- Begin by entering your Social Security Number (SSN) and Federal Employer Identification Number (FEIN) in the designated fields at the top of the form.

- In the Taxpayer Name section, provide the full legal name of the taxpayer or business submitting the form.

- Move to Part I, where you will compute the Reforestation Tax Credit. Start by detailing your total expenditures for eligible reforestation activities in line 1.

- Proceed to line 2, and enter the total cost of approved practices as established by the Mississippi Forestry Commission, which you can calculate using the worksheet on the reverse side of the form.

- In line 3, record the eligible costs, selecting the lesser amount between line 1 and line 2.

- Calculate your earned Reforestation Tax Credit by entering 50% of the amount in line 3 or $10,000, whichever is lower, in line 4.

- If applicable, specify any amounts of Reforestation Tax Credit carried over from previous years in line 5a, and any current year credits passed through from investment in partnerships or other entities in line 5b.

- Sum the amounts from line 4, line 5a, and line 5b to find the total amount of Reforestation Tax Credit available to utilize this year in line 6.

- Complete the selections regarding any federal tax credits elected concerning the qualifying expenditures indicated on the form.

- Continue to Part II, where you will report the amount of total income tax due, as listed in line 7, and any additional credits available to you this year in line 8.

- In line 9, determine your net income tax due by subtracting the total credits from your total income tax due.

- On line 10, enter the lesser amount of line 6 (total RTC) or line 9 (net income tax due) as your Reforestation Tax Credit.

- Move to Part III to compute the carryover amount. Fill out line 11 with the total RTC available, and the RTC utilized this year in line 12.

- Calculate the amount available to carry forward into succeeding years by subtracting line 12 from line 11 in line 13.

- Complete Part IV regarding the lifetime RTC allowance and document any amounts utilized from prior years.

- Lastly, in Part V, ensure certification is signed by a registered forester or individual authorized to verify completion of reforestation practices.

- Once the form is thoroughly completed, you may save your changes, download a copy of the completed form, or print it for submission.

Start filling out your State And Local Tax Weekly For October 27 And November 3 online today!

2023 tax rates and brackets for each filing status Tax RateTaxable income bracket12%$11,001 to $44,725.22%$44,726 to $95,375.24%$95,376 to $182,100.32%$182,101 to $231,250.3 more rows • 5 days ago

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.