Loading

Get Form 2321t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2321t online

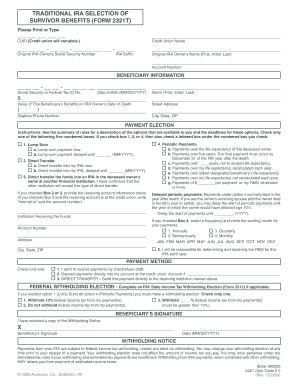

This guide provides clear, step-by-step instructions for filling out the Form 2321t online. Whether you are a beneficiary or a spouse of an IRA owner, these detailed guidelines will assist you in completing the form effectively.

Follow the steps to complete the Form 2321t with ease.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the credit union information in the designated fields, including the credit union name and the CUID provided by the credit union.

- Provide the original IRA owner's Social Security number, IRA suffix, and their full name as requested in the relevant fields.

- In the beneficiary information section, input the beneficiary's Social Security or Federal Tax ID number, date of birth, and full name, along with their street address and daytime phone number.

- Indicate the value of this beneficiary's benefits on the IRA owner's date of death.

- Select your payment election by checking only one of the numbered boxes that best describes your choice. Ensure to check the corresponding lettered box if applicable.

- If you selected box 2 or 3, provide the receiving account information for the funds transfer.

- For periodic payments, indicate the frequency and circle the starting month for your payments if you chose option 4.

- Choose the payment method by checking only one of the options provided for how you want to receive payments.

- Complete the federal withholding election by checking only one option regarding federal income tax withholding, if applicable.

- Sign and date the form to verify that you have received a copy of the withholding notice.

- Once all sections are completed, save your changes, and you may choose to download, print, or share the form as needed.

Start filling out your Form 2321t online today for a smooth process.

The latest IRS update says those heirs won't incur a penalty for missed RMDs for inherited accounts in 2024. But they still must empty the account by the original 10-year deadline. IRS waives required withdrawals from some inherited IRA for 2024 - CNBC cnbc.com https://.cnbc.com › 2024/04/19 › irs-waives-require... cnbc.com https://.cnbc.com › 2024/04/19 › irs-waives-require...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.