Loading

Get Schedule A (form 1040): A Guide To The Itemized Deduction

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out Schedule A (Form 1040): A guide to the itemized deduction online

Filling out the Schedule A (Form 1040) for itemized deductions can seem overwhelming, but this guide is designed to simplify the process. Whether you're a seasoned filer or a first-time user, these steps will help you accurately complete this form online.

Follow the steps to fill out Schedule A effectively.

- Press the ‘Get Form’ button to access the Schedule A online and open it in the digital editor.

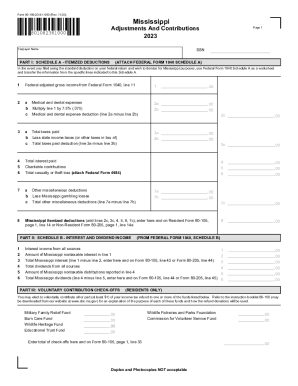

- Begin by entering your federal adjusted gross income from Federal Form 1040, line 11 into line 1 of Schedule A.

- For medical and dental expenses, input the total amount in line 2a. Then, calculate 7.5% of your adjusted gross income by multiplying line 1 by 0.075 and enter this amount in line 2b.

- Subtract the amount in line 2b from line 2a to find your medical and dental expense deduction, and enter this value in line 2c.

- For line 3, enter the total taxes you've paid in line 3a. If applicable, less any state income taxes or other taxes in lieu of on line 3b, and calculate your total taxes paid deduction by subtracting line 3b from line 3a in line 3c.

- Input the total interest paid in line 4.

- Document your charitable contributions in line 5.

- If applicable, report any total casualty or theft loss on line 6.

- Miscalenous deductions can be entered in line 7a, then subtract any Mississippi gambling losses in line 7b and enter the result in line 7c.

- Finally, sum lines 2c, 3c, 4, 5, 6, and 7c. Enter this total as your Mississippi itemized deductions as indicated.

- After completing the form, you can save your changes, download a copy, print it, or share it as needed.

Start filling out your Schedule A online today to maximize your itemized deductions.

For individual taxpayers, Schedule A is used in conjunction with Form 1040 to report itemized deductions. If you choose to claim itemized deductions instead of the standard deduction, you would use Schedule A to list your deductions. Your itemized total is then subtracted from your taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.