Loading

Get Hi N-15 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI N-15 online

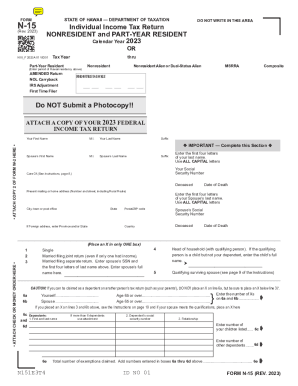

The HI N-15 form is designed for individuals who are nonresidents or part-year residents of Hawaii filing their income tax returns. This guide will provide clear, step-by-step instructions on how to accurately complete the form online, ensuring that you meet all necessary requirements while maximizing your potential benefits.

Follow the steps to complete your HI N-15 form online effectively.

- Press the ‘Get Form’ button to access the HI N-15 document and open it in your browser or preferred PDF editor.

- Enter the tax year in the specified format (MMDDYY) without dashes.

- Indicate your residency status by selecting ‘Part-Year Resident’ or ‘Nonresident.’ If applicable, check the box for ‘Amended Return’ or other options provided.

- Complete the personal information section by entering your first name, middle initial, last name, and suffix. Also, provide your Social Security number and current address.

- If filing jointly, fill out the spouse’s information, including their name and Social Security number.

- Select your appropriate filing status by placing an X in the appropriate box, such as ‘Single’, ‘Married filing jointly’, or ‘Head of household’.

- List any dependents and provide their names and Social Security numbers. Indicate their relationship to you.

- Fill out the income section, detailing your total income, including wages, interest, and any other sources. Attach relevant documents as required.

- Calculate your adjusted gross income by following the instructions provided in the form.

- Complete the deductions section to determine your taxable income. Be sure to follow the specified calculations and instructions.

- After reviewing all sections for accuracy, you may save your changes, download the form, print it, or share it for submission.

Complete your HI N-15 form online today to ensure timely and accurate tax filing.

The state of Hawaii requires you to pay taxes if you are a resident or nonresident and receive income from a Hawaii source. The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.