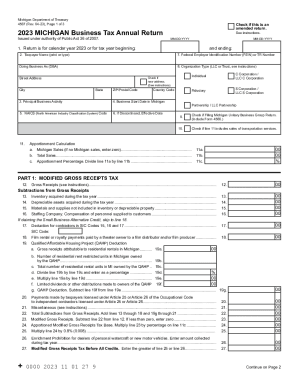

Get 4567, 2023 Michigan Business Tax Annual Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4567, 2023 Michigan Business Tax Annual Return online

This guide provides a clear and supportive approach to completing the 4567, 2023 Michigan Business Tax Annual Return online. It breaks down the components of the form and outlines each step for effective filing.

Follow the steps to complete your tax return online.

- Click ‘Get Form’ button to acquire the 4567 tax form and open it for editing.

- Enter the tax year in line 1 by stating if it is for calendar year 2023 or the specific tax year begin and end dates in MM-DD-YYYY format.

- Input the taxpayer's name in line 2, providing the full legal name as it is registered.

- Provide the Federal Employer Identification Number (FEIN) or TR Number in line 7 along with any Doing Business As (DBA) name.

- Indicate the organization type in line 8 by checking the appropriate box, such as LLC or Trust, according to your entity's formation.

- Complete lines 3 to 6 by detailing the principal business activity, the business start date in Michigan, the NAICS code, and the discontinuance date if applicable.

- For the apportionment calculation, fill in lines 11a to 11c with Michigan sales and total sales, then calculate and enter the apportionment percentage.

- In Part 1, provide the gross receipts in line 12 and fill out lines 13 to 18 as needed, including deductions for inventory and other items.

- Continue with Part 2 by calculating business income on line 28, making necessary additions and subtractions as indicated through lines 29 to 43.

- Progress to Part 3 where total Michigan business tax will be summarized in lines 51 and 52, ensuring required calculations are provided.

- Complete Part 4 detailing payments, refundable credits, and tax due in lines 60 through 70.

- In Part 5, clarify any overpayment in line 71, and decide on amounts to be credited forward in line 72 and to be refunded in line 73.

- Sign and date the return, and ensure your preparer includes their PTIN, FEIN, or SSN along with the business name and contact details.

- Once the form is accurately completed, save your changes, download or print your form, or share it for submission.

Complete your Michigan Business Tax Annual Return online today to ensure accurate filing and compliance.

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax. Select the tax year link desired to display the list of forms available to download. What are the State of Michigan individual income tax filing ... michigan.gov https://.michigan.gov › questions › iit › ion michigan.gov https://.michigan.gov › questions › iit › ion

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.