Loading

Get Mi Form 4884 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form 4884 online

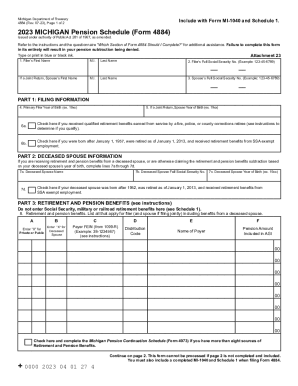

Filling out the MI Form 4884 online is a straightforward process designed to help you claim your pension subtraction effectively. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately.

Follow the steps to complete the MI Form 4884 online

- Press the ‘Get Form’ button to access the MI Form 4884 and open it in the editor for completion.

- Begin by entering the primary filer's first name, middle initial, and last name into the respective fields.

- Input the primary filer's full Social Security number in the designated area. If filing jointly, also provide the spouse’s first name, middle initial, last name, and full Social Security number.

- For filing information, enter the primary filer’s year of birth. If applicable, include the spouse’s year of birth.

- Indicate eligibility for pension benefits by checking the appropriate boxes based on the instructions provided, including any qualifications for fire, police, or county corrections retirees.

- If applicable, fill out the deceased spouse's information including name, Social Security number, and year of birth. Check the box regarding SSA exempt employment as necessary.

- List all retirement and pension benefits for the filer and spouse, marking deceased benefits as necessary. Include payer information and pension amounts.

- Review which section of the form to complete based on the questionnaire in the MI-1040 book. Complete only the relevant section for your situation.

- For the selected section, enter the required information, making sure to follow the calculations as outlined for retirement and pension benefits subtraction.

- Once all sections are filled out accurately, ensure you save your changes. You can then proceed to download, print, or share the completed form as needed.

Start the process of completing your MI Form 4884 online today.

Earned Income Tax Credit Increase The bill will increase the state EITC cap to 30% of the federal credit, beginning in the 2023 tax year. In addition, the bill will allow taxpayers that claim the credit for the 2022 tax year to claim an additional one-time credit equal to 24% of the taxpayer's federal EITC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.