Loading

Get Ca Form 3805e 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3805E online

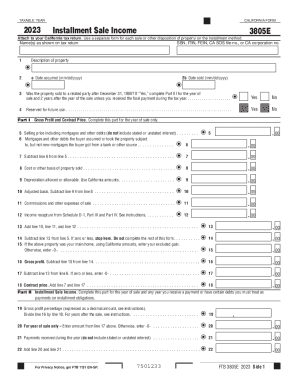

Filling out the CA Form 3805E online can streamline your tax reporting for installment sales. This guide provides a step-by-step approach to ensure you accurately complete the form, making the process easier and more efficient for all users.

Follow the steps to complete the CA Form 3805E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year at the top of the form. For this example, enter '2023' as you will be completing this form for the 2023 tax year.

- Provide your name(s) as shown on your tax return. This helps ensure proper identification in your records.

- In the description of property section, clearly describe the property that was sold or disposed of through an installment sale.

- Fill in the acquisition date of the property in mm/dd/yyyy format for section 2a, followed by the date sold in section 2b.

- Indicate whether the property was sold to a related party after December 31, 1980. If 'Yes,' remember to complete Part III.

- Complete Part I by entering the selling price in line 5, minus any mortgages and debts assumed by the buyer in line 6.

- Calculate the adjusted basis of the property sold by entering your cost basis in line 8 and any depreciation allowed in line 9.

- Sum lines 10, 11, and 12 for your total expenses of sale on line 13.

- Calculate your gross profit by completing lines 14 to 18, checking to ensure no zeros or errors occur.

- Proceed to Part II and enter relevant values for gross profit percentage and installment sale income computations.

- If applicable, complete Part III regarding related party installment sale income. Fill in the necessary details if conditions apply.

- Once all sections are completed, review all entries for accuracy.

- Finally, save your changes, and download, print, or share the form as needed.

Start filling out your CA Form 3805E online today and simplify your tax reporting process.

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.