Loading

Get Ca Form 3800 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3800 online

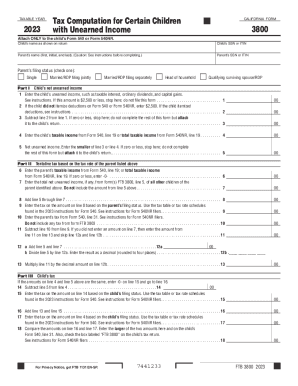

Filling out the California Form 3800 online can streamline the tax process for parents with children who have unearned income. This guide provides clear, step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to fill out the form correctly.

- Select the ‘Get Form’ button to retrieve the form and open it in the editor.

- Begin filling in the child’s name as it appears on their tax return, along with their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Input the parent’s name (first, initial, and last) in the designated field and provide their SSN or ITIN.

- Check the appropriate box for the parent’s filing status, ensuring to select one: single, married/RDP filing jointly, married/RDP filing separately, head of household, or qualifying surviving spouse/RDP.

- In Part I, report the child’s net unearned income by entering the total unearned income (e.g., taxable interest, dividends) on line 1. If this amount is $2,500 or less, stop here and do not file this form.

- If the child did not itemize deductions, enter $2,500 on line 2. If they did itemize deductions, refer to the instructions for further guidance.

- Calculate the difference by subtracting line 2 from line 1 and enter this amount on line 3. If zero or less, discontinue further steps and attach it to the child’s return.

- Record the child’s taxable income from Form 540, line 19, or from Form 540NR, line 19 on line 4.

- For line 5, input the lesser amount from lines 3 or 4. If zero or less, stop here and attach this form to the child’s return.

- Advance to Part II for tax calculations based on the parent’s income. Enter the parent’s taxable income on line 6, followed by net unearned income from any other children on line 7.

- Add lines 5 through 7 together on line 8.

- Using the parent’s filing status, find the applicable tax from line 8 on the tax table or tax rate schedules and enter that amount on line 9.

- Input the parent’s tax from Form 540, line 31, on line 10.

- Calculate the difference by subtracting line 10 from line 9 and record the result on line 11.

- Follow the instructions for lines 12a and 12b to perform necessary calculations for taxable amounts.

- Multiply line 11 by the decimal from line 12b and enter the result on line 13.

- In Part III, determine the child’s tax. If lines 4 and 5 are equal, enter -0- on line 15 and proceed to line 16.

- Complete the calculations as directed through lines 14 to 18, ensuring to check the results accurately reflect the child’s tax obligations.

- Finally, once all sections are complete, save your changes, and download, print, or share the form as needed.

Complete your CA Form 3800 online today for a smoother tax filing experience.

For each child under age 19 or student under age 24 who received more than $2,300 of investment income in 2022, complete Form 540 and form FTB 3800, Tax Computation for Certain Children with Unearned Income, to figure the tax on a separate Form 540 for your child.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.