Loading

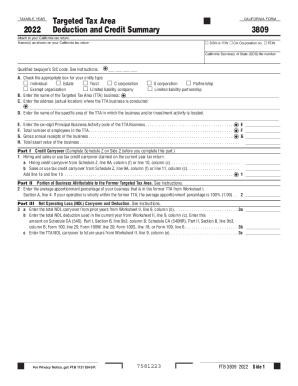

Get 2022 California Form 3809 Targeted Tax Area Deduction And Credit Summary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 California Form 3809 Targeted Tax Area Deduction and Credit Summary online

Filling out the 2022 California Form 3809 can be straightforward with the right guidance. This form, known as the Targeted Tax Area Deduction and Credit Summary, is vital for individuals and entities claiming various deductions and credits related to targeted tax areas in California.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the taxable year in the designated field. For this form, it should be 2022.

- Choose your identification type by checking the appropriate box (SSN or ITIN, California Corporation number, or FEIN).

- Fill in the actual address where the TTA business operates. Ensure accuracy to prevent delays in processing.

- Input your six-digit Principal Business Activity code pertinent to the TTA business.

- Document your gross annual receipts of the business in the given area.

- Complete the Credit Carryover section by following instructions on the form, starting with hiring and sales or use tax credit carryovers.

- Review all fields for accuracy, ensuring no required information is missing or incorrectly entered.

Start filling out your documents online today to ensure you maximize your tax benefits.

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,529 for tax year 2023 as a working family or individual earning up to $30,950 per year. You must claim the credit on the 2023 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.