Loading

Get State And Local Tax Weekly For June 2 And June 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State And Local Tax Weekly For June 2 And June 9 online

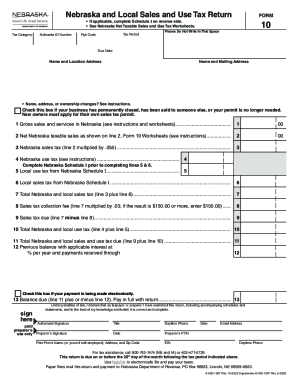

This guide provides an expert overview on completing the State And Local Tax Weekly for June 2 and June 9 online. By following these instructions, users can accurately submit their tax returns while ensuring compliance with state regulations.

Follow the steps to fill out your tax form correctly.

- Click 'Get Form' button to obtain the form and open it in an online editor.

- Enter your Nebraska ID number in the designated field.

- Select the appropriate tax period from the dropdown list corresponding to your reporting date.

- Fill in your name and address details, ensuring they match the information on file with the Nebraska Department of Revenue.

- If applicable, complete Schedule I on the reverse side of the form by entering local sales and use tax amounts.

- Report your gross sales and services in Nebraska on line 1. Refer to the worksheets provided for calculation guidance.

- Complete line 2 with your net Nebraska taxable sales by deducting any allowed exemptions.

- Calculate and enter the Nebraska sales tax amount on line 3 by multiplying the net taxable sales by the state tax rate.

- If applicable, input Nebraska use tax on line 4, referring to instructions for specifics.

- Fill in local use tax and local sales tax from Schedule I on lines 5 and 6 respectively.

- Calculate total Nebraska and local sales tax on line 7 by adding lines 3 and 6.

- Determine the sales tax collection fee on line 8 by multiplying total sales tax by the fee rate, with a maximum of $150.

- Enter the sales tax due on line 9 by subtracting the collection fee from the total sales tax.

- Complete line 10 by adding Nebraska use tax and local use tax.

- Fill in the total sales and use tax due on line 11 by summing lines 9 and 10.

- Review line 12 for any previous balance, including interest and payments received.

- Calculate the balance due on line 13.

- Sign and date the form to affirm accuracy before submission.

- Once your information is complete, save changes, and proceed to download or print the form.

Complete your State And Local Tax Weekly Form online to ensure timely compliance.

The distributional story is similar in 2026 when the baseline changes to an uncapped SALT deduction. Options to put a SALT cap in place would mostly impact higher earners, with the top 20 percent of taxpayers, and especially the top 10 percent, seeing declines in after-tax income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.