Get Mi Cts-02 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI CTS-02 online

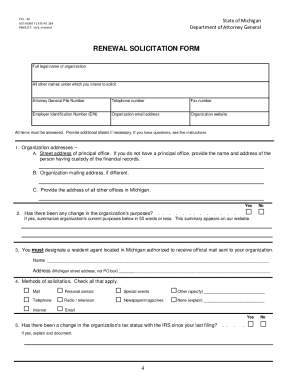

The MI CTS-02 is a renewal solicitation form required for charitable organizations in Michigan to renew their solicitation registration. This guide provides a professional and supportive overview on how to fill out this form online, ensuring compliance with legal requirements.

Follow the steps to successfully complete the MI CTS-02 form.

- Click ‘Get Form’ button to access and open the MI CTS-02 form in your preferred online editor.

- Provide the full legal name of the organization as listed in the articles of incorporation. Include any other names the organization intends to use for solicitation in the designated space.

- Enter the Attorney General File Number assigned to your organization. This number must be included in all correspondence with the Attorney General’s office.

- Input the organization’s contact details, including telephone number, fax number, Employer Identification Number (EIN), email address, and website. Ensure that all information is accurate.

- List the principal office address and any additional addresses or offices in Michigan, ensuring that street addresses are provided instead of P.O. boxes.

- Answer question 2 by indicating any changes in the organization's charitable purposes since the last registration. Provide a brief summary of these changes in 50 words or less.

- Designate a Michigan resident agent by providing their name and street address. This person or entity must be authorized to receive official mail on behalf of the organization.

- Indicate the methods of solicitation employed by checking all applicable boxes. Ensure that you explain any methods marked as 'Other' or 'None.'

- If applicable, provide information regarding any changes in the organization's tax status with the IRS or any issues faced by the organization since the last registration.

- Complete item 9 by listing all professional fundraisers engaged for Michigan fundraising activities and provide the sum of all payments to those fundraisers.

- Report the organization's financial activities for the most recently completed fiscal year in item 10. Depending on the form filed with the IRS, attach the necessary documents as directed.

- Answer following questions about the organization's accomplishments during the reporting period, and complete any additional financial disclosures as instructed in items 11 and 12.

- Review the requirements for audited or reviewed financial statements, and attach any necessary documents if these are required as per the guidelines.

- If applicable, provide details regarding any chapters or divisions under the organization's supervision that are to be included in the registration.

- Finally, certify that you are an authorized representative of the organization by typing or printing your name, title, and date in item 15. Ensure that all information is accurate and complete.

- Once you have completed all sections of the form, you can save your changes, download the completed form, and share or print it as needed for submission.

Complete your MI CTS-02 form online today to ensure your charitable organization remains compliant with Michigan regulations.

Filing an amended tax return in Michigan means you need to correct any errors from your original return. You must complete Form 1040X and provide the necessary information regarding the changes. Depending on your situation, the MI CTS-02 might be relevant in this process. Ensure you follow the guidelines to submit your amended return accurately and on time.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.