Loading

Get Contributor Application - Missouri Department Of Economic ... - Missouridevelopment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Contributor Application - Missouri Department Of Economic Development online

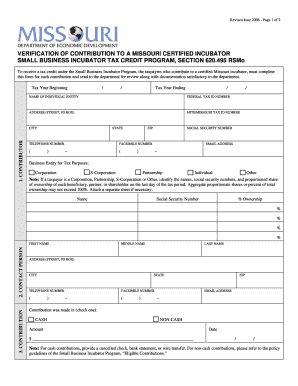

Filling out the Contributor Application is a crucial step for individuals and entities looking to receive tax credits under the Small Business Incubator Tax Credit Program in Missouri. This guide provides clear, step-by-step instructions to help users easily complete the application online.

Follow the steps to successfully complete your application

- Click the ‘Get Form’ button to access the Contributor Application. This will allow you to open the form directly in an online format.

- Fill in the tax year fields, specifying the beginning and ending dates of the relevant tax year. Ensure that these dates are accurate as they will be pertinent for the tax credit eligibility.

- Provide the name of the individual or entity making the contribution along with the federal tax identification number and Missouri tax identification number. Complete the address fields, including street, city, state, and ZIP code. Include the email address and phone number for further communication.

- Designate the type of business entity for tax purposes (corporation, S-corporation, partnership, individual, or other). If applicable, identify the names, social security numbers, and shares of ownership for each beneficiary on the last day of the tax period. This may require additional documentation if there are multiple individuals.

- Detail the contribution by selecting whether it was made in cash or non-cash. Enter the amount and date of the contribution. For cash contributions, you may need to provide supporting documents such as a cancelled check or bank statement as required by the program guidelines.

- Review and complete the certification section, ensuring that all affirmations regarding legal employment practices and understanding of program guidelines are accurately addressed. Make sure to sign in the presence of a notary public.

- The incubator needs to verify the contribution by completing their section. Ensure that the incubator's authorized representative signs and dates the application.

- After completing the application, you can save changes, download the form, or print it for submission. Make sure to submit the completed form and any attached documents to the appropriate department for review.

Complete your Contributor Application online today and take a step towards benefiting from the Small Business Incubator Tax Credit Program.

As the state's number one incentive tool for expansion and retention, this program helps businesses access capital through withholdings or tax credits to embark on facility expansions and create jobs. This program can also help businesses purchase equipment to maintain its facility in Missouri.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.