Loading

Get Md El101 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD EL101 online

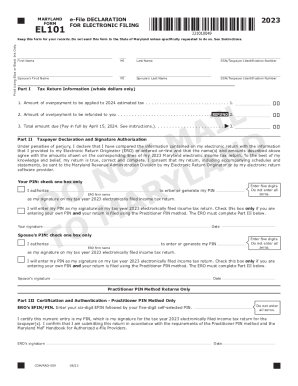

The MD EL101, also known as the e-File declaration for electronic filing, is an important document for taxpayers submitting their electronic returns. This guide provides a comprehensive walkthrough of how to accurately complete this form online, ensuring compliance and efficiency in your filing process.

Follow the steps to successfully complete the MD EL101 online.

- Press the ‘Get Form’ button to access the MD EL101 and open it in the editor.

- Fill out your personal information in the designated fields, including your first name, middle initial, last name, and taxpayer identification number.

- If applicable, enter your spouse's details in the respective fields, including their first name, middle initial, last name, and taxpayer identification number.

- Proceed to Part I of the form, providing the amounts of any overpayments that are to be applied to your 2024 estimated tax or refunded to you, ensuring all figures are in whole dollars.

- In Part II, declare and authorize your PIN. Choose whether you authorize your Electronic Return Originator (ERO) to enter or generate your PIN, or if you will do it yourself. Remember, your PIN must have five digits and cannot be all zeros.

- Sign and date the form in the designated areas, ensuring your signature is handwritten, or use an acceptable method such as a rubber stamp or digital mechanism.

- If applicable, followed by your spouse, enter and authorize their PIN entry in a similar manner.

- For practitioner PIN method returns, complete Part III with the ERO’s Electronic Filing Identification Number (EFIN) and their self-selected PIN.

- Review the entire form to ensure all information is accurate before saving your changes.

- Once completed, you can download, print, or share the edited form as required.

Complete your MD EL101 online today to ensure a smooth filing process.

Related links form

Fiduciary Filing Information Fiduciary tax returns can be filed electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.