Loading

Get Md 502up 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD 502UP online

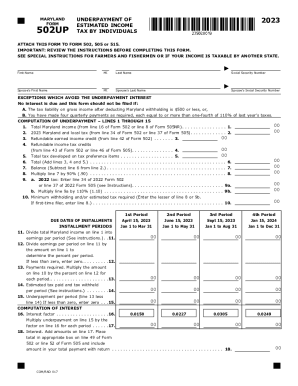

The MD 502UP form is essential for individuals in Maryland who have underpaid their estimated income tax. This guide provides a step-by-step approach to successfully complete the form online, helping users to navigate each section clearly and efficiently.

Follow the steps to successfully complete the MD 502UP online.

- Press the ‘Get Form’ button to retrieve the MD 502UP form and open it in the designated online editor.

- Fill in your first name, middle initial, last name, and social security number in the respective fields. If you have a spouse, provide their first name, middle initial, last name, and social security number as well.

- Review the exceptions section to determine if you need to file. If your tax liability is $500 or less, or you made four quarterly payments, you do not need to file this form.

- For lines 1 through 10, enter your total Maryland income, tax amounts, and any applicable credits as specified in the general instructions.

- Calculate the balance by subtracting the total tax developed from your Maryland and local tax. Multiply the balance by 90% to find the required minimum withholding.

- Determine your income for each installment period and calculate the payments required for each quarter by following the specific instructions given for lines 11 through 15.

- For interest calculations, complete lines 16 through 18 based on any underpayments, ensuring you include the correct interest rates for each period.

- Once all entries are complete and accurate, review the entire form for any errors or missing information.

- Save your changes and download or print the form for your records. Finally, attach the MD 502UP to Forms 502, 505, or 515 when submitting your tax return.

Complete your MD 502UP online today and ensure your tax compliance is up to date.

Standard Deduction - The tax year 2023 standard deduction is a maximum value of $2,550 for single taxpayers and to $5,150 for head of household, a surviving spouse, and taxpayers filing jointly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.