Loading

Get Tx Comptroller 05-166 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-166 online

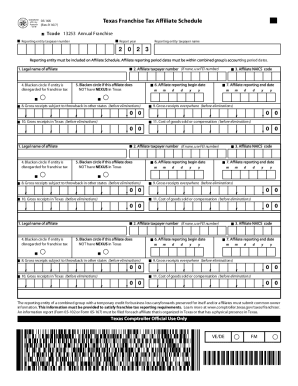

This guide provides a step-by-step approach to effectively completing the TX Comptroller 05-166 form online. The TX Comptroller 05-166 is essential for reporting franchise tax information for businesses and partnerships operating in Texas.

Follow the steps to accurately fill out the TX Comptroller 05-166.

- Click the ‘Get Form’ button to access the TX Comptroller 05-166 form and open it for editing.

- Enter the report year in the designated field. For instance, if you are filling out the form for the year 2023, ensure that '2023' is noted clearly.

- Provide the reporting entity's taxpayer number. If the entity is disregarded for franchise tax, mark the corresponding circle to indicate this status.

- Input the gross receipts subject to throwback in other states in the next field if applicable. Make sure to enter this amount before any eliminations.

- Complete the fields for gross receipts everywhere and gross receipts in Texas before eliminations. These amounts should reflect your total sales and operations.

- If applicable, indicate the cost of goods sold or compensation before any eliminations to provide a clear picture of your operating expenses.

- Ensure all fields are filled out accurately and review your information for completeness.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Start completing your TX Comptroller 05-166 form online today to ensure timely reporting!

You may qualify for penalty relief if you demonstrate that you exercised ordinary care and prudence and were nevertheless unable to file your return or pay your taxes on time. Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.