Loading

Get Form Il-8633-i, Application To File Illinois Individual Income ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form F-1065, Florida Partnership Information Return online

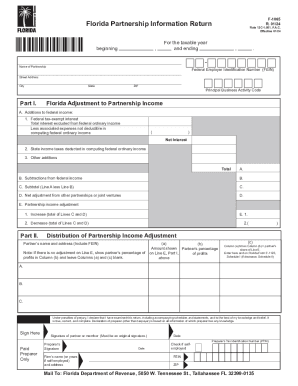

Filling out the Form F-1065, Florida Partnership Information Return, is essential for every partnership with a partner subject to the Florida Corporate Income Tax Code. This guide provides clear, step-by-step instructions to help users navigate through the form efficiently online.

Follow the steps to complete your Florida Partnership Information Return

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year for which the return is being filed, including the partnership's name, address, and federal employer identification number (FEIN). Ensure that all fields are filled out with accurate information.

- In Part I, add any federal tax-exempt interest to your federal income and subtract associated expenses. Calculate the total for Line A and the subtractions for Line B. Then, compute the subtotal for Line C by subtracting Line B from Line A.

- Complete any necessary adjustments from other partnerships on Line D, and sum for Line E to finalize your partnership income adjustment.

- Proceed to Part II to distribute the partnership income adjustment to your partners. Input each partner's name, percentage of profits, and calculate their respective share based on Line E from Part I.

- Fill out Part III with the apportionment information, ensuring you include required figures for property, payroll, and sales, both within Florida and total everywhere.

- Review all entries for accuracy, then finalize your document by checking the signature section for any person authorized to sign on behalf of the partnership, ensuring their original signature is included.

- Save changes to your completed form, and choose to download, print, or share the form as required for submission to the Florida Department of Revenue.

Complete your Form F-1065 online today to stay compliant with Florida tax regulations!

We encourage you to use electronic methods to ensure timely receipt of payments. The following electronic methods available to pay your individual income tax are: MyTax Illinois (electronic payment taken from your checking or savings account) Credit Card (Visa, MasterCard, Discover, or American Express)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.