Loading

Get Ar Ar1075 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR1075 online

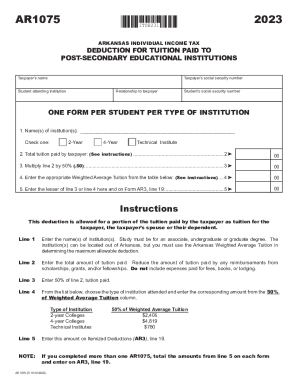

This guide provides clear instructions for users looking to complete the AR AR1075 form online. It outlines each section and field, ensuring a smooth process for claiming the deduction for tuition paid to post-secondary educational institutions.

Follow the steps to accurately fill out the AR AR1075 form.

- Press the ‘Get Form’ button to access the AR AR1075 form and open it for editing.

- Begin by entering the taxpayer's name at the designated field. It is essential to ensure accurate spelling.

- Next, input the taxpayer's social security number in the provided section. This is crucial for identification.

- Indicate the relationship of the student attending the institution to the taxpayer in the corresponding field.

- Record the student's name and social security number. This information is vital for the form.

- List the name(s) of the institution(s) the student attended. You may include institutions from outside Arkansas, but be sure to adhere to the requirements for the deduction.

- Check the appropriate box for the type of institution: 2-Year, 4-Year, or Technical Institute.

- Enter the total amount of tuition paid by the taxpayer on line 2. Remember to reduce this by any scholarships, grants, or reimbursements received.

- On line 3, calculate and input 50% of the tuition amount stated on line 2.

- Referring to the provided table, select the correct Weighted Average Tuition amount based on the institution type, and enter it on line 4.

- Finally, on line 5, enter the lesser amount between lines 3 and 4. This amount will also need to be recorded on Form AR3, line 19.

- If multiple forms have been filled out, total the amounts from line 5 for each form and record the total on Form AR3.

- Once all fields are completed, ensure you save your changes, and then you can download, print, or share the completed form as necessary.

Start filling out your AR AR1075 form online today to claim your education deduction!

The law will cut income taxes in the state of Arkansas. It will reduce the personal income tax rate to 4.4% for those with a net income greater than $24,300. The corporate income tax rate will be lowered for corporations with a net income greater than $11,000 to 4.8%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.