Loading

Get Irs 5329 2023

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5329 online

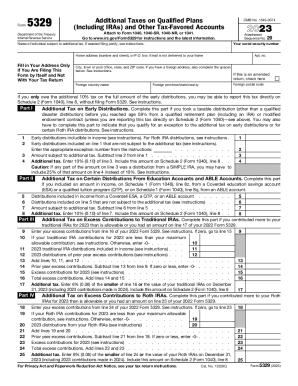

Filling out the IRS 5329 form accurately is essential for reporting additional taxes on qualified retirement plans and other tax-favored accounts. This guide provides clear and comprehensive steps to assist users in completing the IRS 5329 form online.

Follow the steps to complete your IRS 5329 form online.

- Click 'Get Form' button to access the IRS 5329 form and open it in the online editor.

- Input your social security number in the designated field to identify your tax record.

- Provide the name of the individual subject to additional tax. If you are filing jointly, make sure to follow the instructions for married couples.

- Complete your home address, including the number and street or P.O. box. Only fill in this section if the form is not being submitted with your tax return.

- Enter your city, state, and ZIP code. For foreign addresses, include the necessary additional information as instructed.

- Indicate if this is an amended return by checking the appropriate box.

- For Part I, report any early distributions you received from retirement plans or modified endowment contracts. Fill in the necessary lines and provide the amount subject to additional tax based on instructions.

- Complete Part II if applicable, detailing additional tax on distributions from education and ABLE accounts.

- Proceed to Part III and IV for reporting excess contributions to traditional and Roth IRAs respectively, filling out all required lines.

- Continue through subsequent parts (V to IX) as necessary, filling in any excess contributions or calculations for various accounts.

- Once all sections are completed, review the form for accuracy. You can then choose to save changes, download, print, or share the completed IRS 5329 form.

Ensure your tax obligations are met by filing the IRS 5329 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

RMD shortfalls result in heavy penalties for the missed amount. Fortunately, Form 5329 allows you to appeal to the IRS for a penalty waiver. Sending a penalty waiver letter is an essential part of your request, as it outlines your situation and explains why you missed your RMD.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.