Loading

Get Nh Dor Dp-14 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DoR DP-14 online

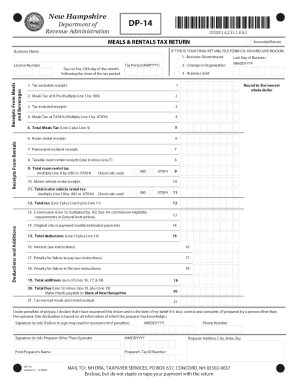

Filling out the NH DoR DP-14 form online can be a straightforward process with the right guidance. This document serves as a comprehensive guide to help you effectively complete the Meals and Rentals Tax Return, ensuring that all necessary information is accurately provided.

Follow the steps to fill out the NH DoR DP-14 online.

- Press the ‘Get Form’ button to access the online version of the NH DoR DP-14 and open it in the form editor.

- Identify whether you are filing an amended return by checking the appropriate box. If this is your final return, indicate the reason and provide your last day of business.

- Enter your business name on the line provided.

- Input your six-digit Meals & Rentals Tax Operator's License number in the designated block.

- Specify the tax period for which you are filing the return.

- On Line 1, enter your receipts from rentals where the tax is not included in the sale price.

- Calculate the Meals Tax for tax excluded receipts by multiplying Line 1 by 0.085 and enter the result on Line 2.

- On Line 3, enter the gross receipts from sales where the tax is included in the price.

- Compute the Meals Tax for tax included receipts by multiplying Line 3 by 0.07834 and enter this on Line 4.

- Add Line 2 and Line 4 to get the total Meals Tax and enter the result on Line 5, rounding to the nearest whole dollar.

- On Line 6, input the total room rental receipts, subtracting any tax-exempt amounts.

- Enter permanent resident receipts on Line 7, noting that these are not subject to the tax.

- Calculate taxable room rental receipts by subtracting Line 7 from Line 6 and enter this on Line 8.

- Determine the total room rental tax by multiplying Line 8 by the appropriate tax rate, either 0.085 or 0.07834, and record the result on Line 9.

- On Line 10, enter total motor vehicle rental receipts, excluding any tax-exempt amounts.

- Calculate the total motor vehicle rental tax by multiplying Line 10 by the applicable rate and enter the result on Line 11.

- Sum Lines 5, 9, and 11 to determine the total tax due and enter the total on Line 12.

- Calculate any deductions using Lines 13 and 14 and enter the total on Line 15.

- Calculate interest due on any unpaid taxes and enter this on Line 16.

- If applicable, calculate any penalties for late payment on Line 17 and penalties for failure to file on Line 18.

- Sum Lines 16, 17, and 18 to find total additions to tax and enter on Line 19.

- Determine the final amount due by subtracting Line 15 from Line 12 and adding Line 19. Enter this on Line 20.

- If applicable, enter any tax-exempt meals or rental receipts on Line 21.

- Sign and date the form in ink to verify accuracy. If someone else prepared the return, they must also sign and provide their identification details.

- Finally, ensure you save your changes, download a copy, or print the completed form for your records before submission.

Complete the NH DoR DP-14 online today to ensure your tax responsibilities are met promptly.

It is a tax on interest and dividend income. Please note that the I&D Tax is being phased out. The I&D Tax rate is 5% for taxable periods ending before December 31, 2023. That rate is 4% for taxable periods ending on or after December 31, 2023, and 3% for taxable periods ending on or after December 31, 2024.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.