Get Irs 13551 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 13551 online

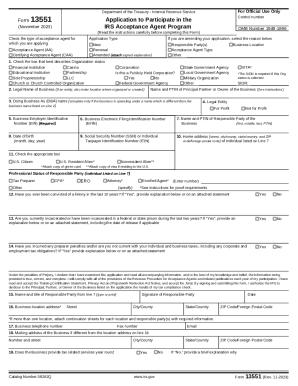

This guide provides step-by-step instructions on how to complete the IRS Form 13551, which is essential for applying to participate in the IRS Acceptance Agent Program. Designed for both new applicants and those renewing their status, this resource aims to make the process straightforward and accessible for all users.

Follow the steps to successfully complete the IRS 13551 online

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital format.

- Select the appropriate application type. You can choose from 'New', 'Renewal', or 'Amended'. Make sure to select the correct option to proceed.

- Identify your acceptance agent type by checking the relevant box, either 'Acceptance Agent (AA)' or 'Certifying Acceptance Agent (CAA)'.

- Provide the legal name of the business, along with the principal, partner, or owner details, including their Preparer Tax Identification Number (PTIN), if available.

- Specify the doing business as (DBA) name if applicable, and check the box that best describes your organizational status, such as financial institution or partnership.

- Enter your Employer Identification Number (EIN) on the form, as it is required for submission.

- Complete the information for the responsible party, which includes their name, PTIN, date of birth, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Fill in the full address, professional status, and any relevant legal status details for the responsible party.

- Answer the suitability questions regarding prior convictions or tax compliance penalties, providing explanations as necessary.

- Review your answers to ensure all information is complete and accurate, then proceed to sign the form electronically.

- Once finished, you can save changes, download the completed form, or print and share it as needed.

Start filling out your IRS 13551 application online today for a smooth submission process.

An ITIN is a 9-digit number issued by the U.S. Internal Revenue Service (IRS) to individuals who are required for U.S. federal tax purposes to have a U.S. taxpayer identification number but who do not have and are not eligible to get a Social Security number (SSN). About Form W-7, Application for IRS Individual Taxpayer Identification ... irs.gov https://.irs.gov › forms-pubs › about-form-w-7 irs.gov https://.irs.gov › forms-pubs › about-form-w-7

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.