Loading

Get Lender's Application For Guaranty (please Print Legibly Or ... - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LENDER'S APPLICATION FOR GUARANTY online

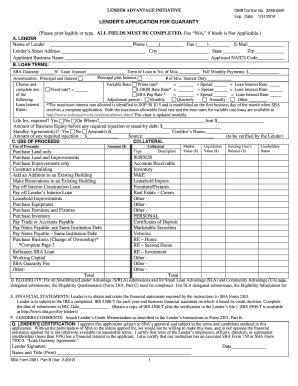

Completing the Lender's Application for Guaranty is essential for lenders seeking SBA loan guarantees. This guide will provide step-by-step instructions to help you navigate the form efficiently and accurately.

Follow the steps to successfully complete the application.

- Press the 'Get Form' button to access the form and open it in the available editor format.

- In Section A, provide the lender's name, contact details (phone, fax, email), address, the applicant business name, and the NAICS code. Make sure all fields are filled accurately.

- In Section B, specify the loan terms. Fill in the SBA Guaranty percentage, loan amount, term of the loan, and full monthly payments. Indicate if the loan is fixed or variable rate and provide the necessary details.

- In Section C, indicate the use of proceeds. Check all relevant boxes for the intended use of funds, such as equipment purchases or working capital, and provide details on collateral as required.

- For Section D, complete the eligibility questionnaire as needed. Make sure this section complies with the SBA requirements for the specific loan program.

- In Section E, collect and retain the necessary financial statements from the applicant. This includes analyzing their financial status and submitting necessary documents to the IRS.

- For Section F, include the lender's comments and credit memorandum that provide insights into the credit decision process based on the applicant's profile.

- Finally, in Section G, the lender must certify the application by signing and dating the form, confirming the accuracy of the details provided.

- Once all sections are completed, save the changes, and you may download, print, or share the form as needed.

Complete your SBA forms online effortlessly to ensure your loan application process is smooth and efficient.

3 Key Advantages of an SBA Loan Collateral and equity requirements can be less than traditional loan requirements. Collateral is tangible; it is something you can touch. ... Longer repayment terms. The SBA is able to offer loans with longer repayment terms and higher borrowing limits. ... Access to SBA resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.