Loading

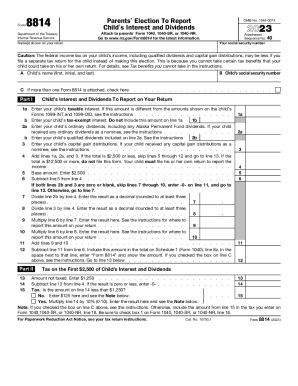

Get Instructions For Form 8814 (2023)internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Form 8814 (2023) Internal Revenue Service online

Understanding how to fill out the Instructions For Form 8814 is essential for parents reporting their child's interest and dividends to the Internal Revenue Service. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal details in the section labeled 'Your social security number' and 'Name(s) shown on your return'. Make sure to provide accurate information as it appears on your official documents.

- In part I, fill in your child's name and social security number in the designated fields. Ensure that the name matches the one on their social security card.

- Report your child's taxable interest on line 1a. If this amount differs from what's shown on Forms 1099-INT or 1099-OID, consult the provided instructions for adjustments.

- On line 1b, enter the amount of any tax-exempt interest your child received, ensuring it is listed separately from taxable interest.

- For line 2a, indicate your child's ordinary dividends, including Alaska Permanent Fund dividends, referencing any nominee amounts in the instructions if applicable.

- Enter any qualified dividends received by your child in line 2b, bearing in mind the guidelines for entry.

- On line 3, report your child's capital gain distributions, noting that any nominee distributions must be referred to in the instructions.

- Sum lines 1a, 2a, and 3 to determine the total reportable income. If the total is $2,500 or less, continue to line 13. If it exceeds $12,500, your child must file their own return.

- Continue filling out the form as instructed, paying attention to the calculations between sections Part I and Part II, especially tax calculations based on your child's income.

- Finally, once you have completed the form and checked it for accuracy, you can save changes, download, print, or share the form as needed.

Start filing your form online to ensure accurate reporting of your child's interest and dividends.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When you report your child's interest and dividend income on your return, file Form 8814 with your return. If your child files their own return and the kiddie tax applies, file Form 8615 with the child's return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.