Loading

Get Treasury And Irs Propose New Tax Form For Corporate ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Treasury and IRS propose new tax form for corporate online

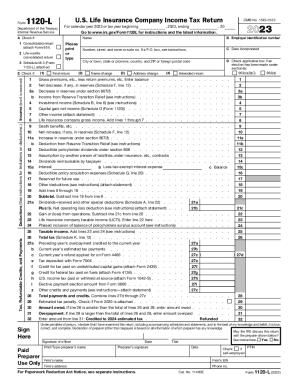

This guide provides a clear and comprehensive overview of completing the Treasury and IRS proposed tax form for corporations, specifically Form 1120-L for the U.S. Life Insurance Company Income Tax Return. Understanding how to accurately fill out this form is crucial for compliance and proper tax reporting.

Follow the steps to efficiently complete the tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the employer identification number (EIN) in section B. Ensure this number matches the IRS records for accurate filing.

- Complete section C by providing the date of incorporation along with the full address of the corporation, ensuring no details are overlooked.

- In section D, check any applicable boxes, such as if you have made an election under specific sections of the tax code.

- Enter the gross premiums and other income on the designated lines for accurate reporting of financial data.

- Calculate deductions and credits by following the instructions for each relevant section, ensuring all required statements are attached as needed.

- Review the completed form for any errors or omissions before proceeding to the final step.

- Once all sections are filled in, you can save your changes, download a copy for your records, print it out, or share it as necessary.

Take the next step in your corporate tax compliance by completing the form online today.

This is the government's way of ensuring that you pay at least a minimum amount of tax. AMT liability is determined in a separate tax computation based on your “adjusted taxable income”. Adjusted taxable income is determined by taking your net taxable income and adjusting for certain “tax preference items”.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.