Get Irs 990 Instructions 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign IRS 990 Instructions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Tips on how to fill out, edit and sign IRS 990 Instructions online

How to edit IRS 990 Instructions: customize forms online

Use our advanced editor to transform a simple online template into a completed document. Read on to learn how to modify IRS 990 Instructions online easily.

Once you find an ideal IRS 990 Instructions, all you need to do is adjust the template to your needs or legal requirements. In addition to completing the fillable form with accurate data, you may need to delete some provisions in the document that are irrelevant to your circumstance. On the other hand, you might want to add some missing conditions in the original template. Our advanced document editing tools are the simplest way to fix and adjust the document.

The editor allows you to change the content of any form, even if the file is in PDF format. You can add and remove text, insert fillable fields, and make extra changes while keeping the original formatting of the document. Also you can rearrange the structure of the document by changing page order.

You don’t need to print the IRS 990 Instructions to sign it. The editor comes along with electronic signature capabilities. The majority of the forms already have signature fields. So, you just need to add your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to make your IRS 990 Instructions:

- Open the preferred template.

- Use the toolbar to adjust the template to your preferences.

- Complete the form providing accurate information.

- Click on the signature field and add your eSignature.

- Send the document for signature to other signers if needed.

Once all parties complete the document, you will get a signed copy which you can download, print, and share with others.

Our services allow you to save tons of your time and reduce the risk of an error in your documents. Streamline your document workflows with efficient editing tools and a powerful eSignature solution.

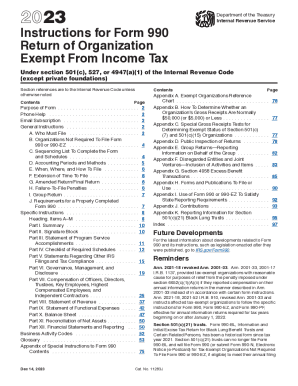

Most charitable nonprofits that are recognized by the IRS as tax-exempt have an obligation to file IRS Form 990, which is an annual information return to be filed with the IRS by the 15th day of the 5th month after the end of the organization's accounting period. (There are some exceptions.)

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.