Loading

Get Irs 5471 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 online

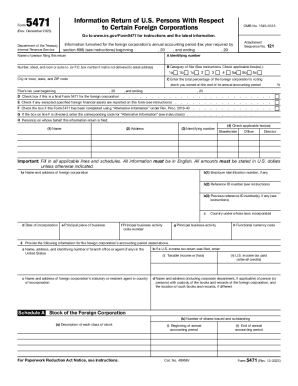

Filling out the IRS 5471 form can seem daunting, but this guide provides clear, step-by-step instructions to help you navigate each section. Understanding the components of the form is essential for ensuring compliance with U.S. tax regulations related to foreign corporations.

Follow the steps to complete the IRS 5471 form accurately.

- Click ‘Get Form’ button to download the IRS 5471 form and open it in your preferred editing tool.

- Fill in the information regarding the foreign corporation’s annual accounting period, including the start and end dates.

- Select the category of filer by checking the applicable boxes.

- Complete section C related to foreign corporation details such as the name, address, and employer identification number.

- Proceed to provide the necessary financial information in Schedule A regarding the stock of the foreign corporation.

- Fill out Schedule B to list U.S. shareholders of the foreign corporation.

- Complete Schedule C and F: Report the income statement and balance sheet information accurately.

- Answer the questions in Schedule G regarding additional foreign corporation activities.

- Review all entries made for accuracy and completeness, ensuring that all necessary schedules are attached.

- Once you have validated the form, save your changes, and download or print the completed IRS 5471 form for your records.

Start filling out your IRS 5471 form online today and ensure your compliance with foreign corporation regulations.

One example that would trigger an obligation to file a Form 5471 is if a corporation has had more than a 10 percent change in ownership. However, there are categories which apply to officers of a corporation as well so you may want to look further to determine whether your particular circumstances require you to file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.