Loading

Get Alaska Mining License Tax Return (short Form)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alaska Mining License Tax Return (Short Form) online

Filing the Alaska Mining License Tax Return (Short Form) is essential for individuals or businesses operating mining operations in Alaska. This guide provides a clear, step-by-step approach to completing the form online while ensuring compliance with state regulations.

Follow the steps to complete the form efficiently.

- Use the ‘Get Form’ button to access the Alaska Mining License Tax Return (Short Form) and open it in the editor.

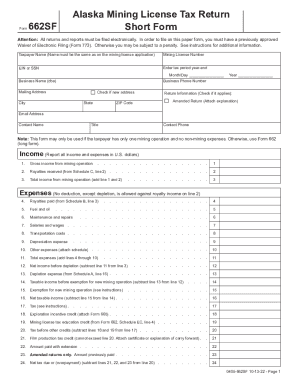

- In the first section, enter the taxpayer name exactly as it appears on the mining license application. Fill in the mining license number, EIN or SSN, and the tax period year-end.

- Provide the business name (doing business as) and contact information, including the business phone number, mailing address, city, state, ZIP code, and email address. If applicable, check the box for a new address.

- If you are filing an amended return, check the appropriate box and attach a detailed explanation for the amendment.

- Report your income from mining operations by entering the gross income in the first line of the income section. Follow this with any royalties received, and calculate the total income by adding the two amounts.

- In the expenses section, list various expenses such as royalties paid, fuel and oil, maintenance and repairs, salaries and wages, transportation costs, depreciation expense, and any other applicable expenses. Calculate the total expenses by summing all entries.

- After determining your total income and expenses, calculate the net income before depletion by subtracting total expenses from total income.

- Follow the instructions to calculate the taxable income and any exemptions for new mining operations. Enter the final taxable income and applicable credits.

- Complete the last part of the form by entering all liability details, including any amounts due, credits, and overpayments.

- After reviewing all entries for accuracy, you can save changes, download, print, or share the completed form as needed.

Begin completing your Alaska Mining License Tax Return (Short Form) online today for a smooth filing experience.

In Alaska, production royalties are 3 percent of a miner's net income as calculated through the mining license tax. From that 3 percent, miners can deduct the rent they pay to the state for the claim/lease that produced the mineral.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.