Loading

Get Ky 8582-k 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 8582-K online

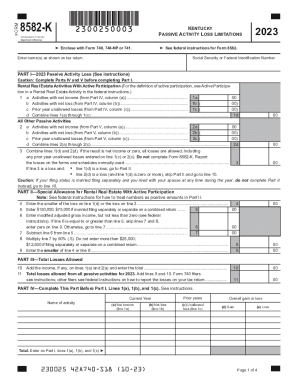

Filling out the KY 8582-K form is essential for reporting passive activity losses for the Commonwealth of Kentucky. This guide offers clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to complete the KY 8582-K form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) exactly as shown on your tax return in the designated field at the top of the form.

- Provide your Social Security number or Federal Identification Number in the appropriate section to identify your tax record.

- Complete Parts IV and V before filling out Part I to ensure accurate reporting of rental real estate activities and any prior year unallowed losses.

- In Part I, section 1(a) through 1(c), enter figures for activities with net income, net loss, and prior year unallowed losses under Rental Real Estate Activities With Active Participation.

- Proceed to section 2(a) through 2(c) to report figures for all other passive activities in a similar manner.

- Combine totals from lines 1(d) and 2(d) in line 3 to determine if all losses are allowed or if you need to finish filling out Part II.

- If necessary, complete Part II to determine the special allowance for rental real estate with active participation, entering required figures as prompted.

- Add any income from lines 1(a) and 2(a) in Part III to find total allowable losses for the year.

- Fill out Parts IV, V, VI, VII, and VIII with the relevant information about activities and losses, following the structure illustrated in the form as you proceed.

- After completing all sections, review your entries for accuracy. Save changes, download the form, print it, or share it with the relevant tax authorities as needed.

Start completing your KY 8582-K form online today.

Under the passive activity rules you can deduct up to $25,000 in passive losses against your ordinary income (W-2 wages) if your modified adjusted gross income (MAGI) is $100,000 or less. This deduction phases out $1 for every $2 of MAGI above $100,000 until $150,000 when it is completely phased out.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.