Loading

Get Wi Wt-11 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI WT-11 online

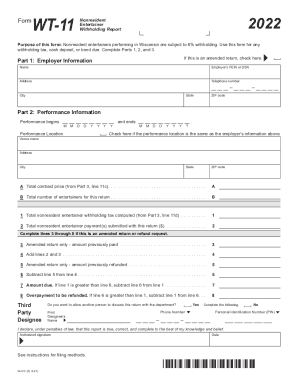

Filling out the WI WT-11 form is crucial for nonresident entertainers performing in Wisconsin. This guide provides clear instructions on each section of the form to help users complete it accurately and efficiently.

Follow the steps to fill out the WI WT-11 form effectively.

- Click the ‘Get Form’ button to access the WI WT-11 form and open it in your preferred digital editor.

- In Part 1, enter the employer's information. Provide the employer's name, Federal Employer Identification Number (FEIN) or Social Security Number (SSN), address, telephone number, city, state, and ZIP code.

- Move to Part 2 to fill out performance information. Enter the performance start and end dates, performance location, and venue name. If the performance location is the same as the employer's address, check the appropriate box.

- Complete the financial details in Part 2 by specifying the total contract price and the number of entertainers covered in this return. Include the total nonresident entertainer withholding tax computed from Part 3.

- If this is an amended return, fill out lines 3 to 8 with relevant amounts related to previous payments and refunds. Ensure that calculations reflect any adjustments.

- Designate a third party, if desired, by providing their name and phone number in the appropriate section. This allows them to discuss the return with the department.

- Sign and date the form, affirming that the information provided is accurate. Ensure to include your Personal Identification Number (PIN) if applicable.

- Review the form for any errors, then save the changes. You can then download, print, or share the form as needed.

Complete your forms online with ease and accuracy.

Each employer who withholds Wisconsin income tax is required to remit the amount withheld via the withholding deposit report (Form WT-6) or the annual reconciliation (Form WT-7), ing to the employer's assigned filing frequency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.