Loading

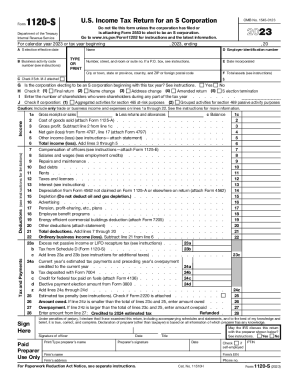

Get Irs 1120s 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S online

Filing the IRS 1120S form is essential for S corporations in reporting income, deductions, and credits. This guide offers clear, step-by-step instructions to help users complete the form online effectively, making the process manageable for everyone.

Follow the steps to fill out the IRS 1120S form online

- Click the 'Get Form' button to access the IRS 1120S form and open it in the editor.

- Provide the corporation's name and Employer Identification Number (EIN) in the designated fields. Ensure accuracy as this information is crucial for processing.

- Select the appropriate checkboxes if the corporation is electing to be an S corporation for this tax year. This includes indicating if the form is a final return or if there are significant changes such as a name or address change.

- Fill in the corporation's date of incorporation and business activity code number. These details help categorize the entity correctly.

- In the 'Income' section, report gross receipts, sales, and any deductions. Only include business-related income and expenses as outlined in the form instructions.

- Complete the deductions section carefully, attaching any necessary forms like Form 1125-A for cost of goods sold, ensuring that all deductions are justified and appropriately documented.

- Review the tax and payment entries, including estimated tax payments, to ensure accuracy before moving forward.

- Address any remaining sections, including Schedules K and M, which report shareholders’ share items and reconcile income as required.

- Once all fields are completed, double-check the entire form for any errors or omissions. This helps avoid common pitfalls during the submission process.

- Save changes, download the completed form, and utilize options to print or share the document as needed.

Start filling out your IRS 1120S form online today for smooth and efficient tax reporting.

You can download Form 1120S directly from the IRS website. Or if you use tax software, you can find it there too.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.