Loading

Get Or Form Or-slt-v 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form OR-SLT-V online

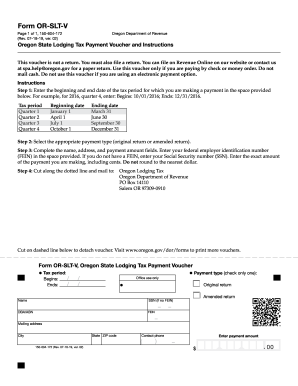

Filling out the OR Form OR-SLT-V online can help you streamline the process of paying your lodging taxes in Oregon. This guide provides clear, step-by-step instructions for accurately completing the form and ensures you meet your obligations efficiently.

Follow the steps to accurately complete the OR Form OR-SLT-V online.

- Press the ‘Get Form’ button to access the form and open it in your chosen online document editor.

- In the section titled 'Tax period', enter the beginning and end date of the tax period for which you are making a payment. For example, if you are filing for the fourth quarter of 2016, input: Begins: 10/01/2016; Ends: 12/31/2016.

- Select the appropriate payment type by checking either 'Original return' or 'Amended return.' Complete the fields for your name, mailing address, and the exact payment amount. Input your federal employer identification number (FEIN) or, if unavailable, your Social Security number (SSN). Ensure that the payment amount is recorded correctly down to the cents without rounding.

- Once all fields are completed, cut along the dotted line to detach the voucher from the rest of the document. Prepare to mail the completed voucher to the provided address: Oregon Lodging Tax, Oregon Department of Revenue, PO Box 14110, Salem OR 97309-0910.

- After completing the form, you have the option to save your changes, download the document for your records, print a copy, or share the form as needed.

Complete your OR Form OR-SLT-V online today to ensure timely lodging tax payments.

We accept most tax returns as filed, but to ensure the accuracy of voluntary compliance, we audit a variety of returns each year. Once a return is assigned to one of our auditors, an audit appointment or correspondence letter is sent. This letter will ask you to submit information required for the audit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.