Loading

Get Irs 8038 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8038 online

This guide provides clear and comprehensive instructions for completing the IRS Form 8038 online. Whether you are familiar with tax documents or new to the process, this step-by-step approach will help ensure correct completion.

Follow the steps to successfully complete and submit your IRS 8038 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the issuer's name and employer identification number. Provide the contact information for the person with whom the IRS may communicate regarding this return.

- Fill in the issuer's address, including the number and street (or P.O. box), city, town, state, and ZIP code.

- Indicate the date of issue in the format MM/DD/YYYY. Specify the name of the issue and the CUSIP number.

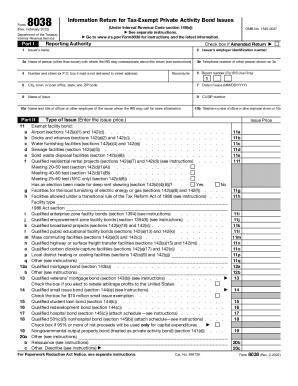

- Complete Part II by selecting the type of issue and entering the issue price. Mark any relevant boxes regarding specific bond types or elections.

- In Part III, describe the bonds being issued. Include the final maturity date, issue price, stated redemption price at maturity, and weighted average maturity.

- Proceed to Part IV where you will list the uses of proceeds. Detail amounts allocated for accrued interest, bond issuance costs, and other categories specified.

- Part V requires you to describe the property financed by the proceeds. Specify the type of property and complete the section with the appropriate NAICS codes.

- If applicable, provide details in Part VI regarding any refunded bonds. Include weighted average maturities and dates for both tax-exempt and taxable bonds.

- In Part VII, enter information pertaining to any governmental approvals and miscellaneous considerations. Fill out any checks if required, related to penalties or hedging.

- Finally, complete the signature and declaration section. Ensure the authorized representative signs and dates the form.

- Once all fields are completed, you can save changes, download, print, or share the form online.

Complete your IRS Form 8038 online to ensure compliance and timely submission.

Form 8038-CP is a return of the issuer, and as such, must be signed by an officer of the issuer with the authority to: (i) bind the issuer; (ii) authorize payment to be sent to the entity listed in Part I; and (iii) authorize the IRS to communicate with any person listed as a designee of the issuer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.