Loading

Get It 215 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 215 2013 Form online

Completing the IT 215 form online can seem daunting, but with a step-by-step approach, you'll be able to navigate through it efficiently. This guide is designed to support you in understanding the key components and sections of the form, ensuring you complete it correctly for your tax needs.

Follow the steps to fill out the It 215 form online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

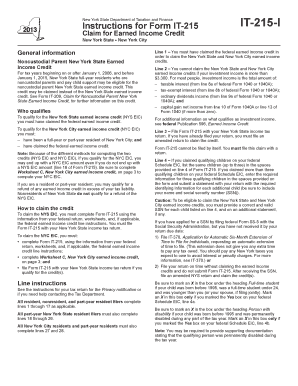

- Read through the general information section to understand eligibility requirements for the New York State Earned Income Credit (NYS EIC) and New York City Earned Income Credit (NYC EIC). Make sure you have claimed the federal earned income credit.

- Fill out the top section of the form, providing your personal information as required, including Social Security numbers and filing status.

- Proceed to check the eligibility criteria on Line 1, confirming that you have claimed the federal earned income credit.

- On Line 2, confirm that your investment income is $3,300 or less. This section may require you to calculate and include information regarding your investment income.

- For Line 3, remember to file your IT 215 alongside your New York State income tax return; it cannot be submitted independently.

- Complete Line 4 by listing qualifying children if you claimed them on your federal Schedule EIC. Ensure you provide valid Social Security numbers for each child.

- Proceed with additional fields as instructed. This may include completing Worksheets A and B as directed for income calculations.

- Ensure all relevant lines pertaining to your situation (lines 5 to 26) are filled out accurately, verifying the amounts you enter against your federal return.

- For the NYC EIC, if applicable, complete Worksheet C and enter the calculated amounts on lines 27 and 28 of the form.

- Review the entire form for accuracy, ensure all required information is included, and any worksheets are attached as needed.

- Once completed, save your changes, then download, print, or share the form as required for your submission.

Start filling out your documents online today to ensure you receive the credits you are eligible for.

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.