Loading

Get Il Imrf 6.11a 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL IMRF 6.11A online

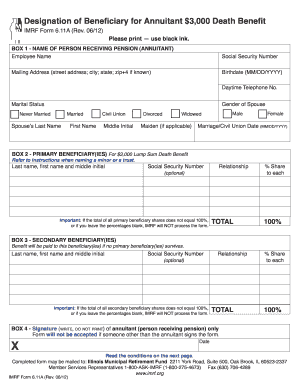

Filling out the IL IMRF 6.11A form is an important step in designating beneficiaries for your $3,000 death benefit. This guide provides a clear and comprehensive overview to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the IL IMRF 6.11A form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name, mailing address, social security number, birthdate, and daytime telephone number in the designated fields. Make sure to provide accurate information.

- Select your marital status by checking the corresponding box. If married, provide your spouse's last name, first name, civil union status, middle initial, and date of marriage or civil union.

- In Box 2, list your primary beneficiary or beneficiaries. Include their last name, first name, middle initial, social security number, and the percentage share for each beneficiary. Ensure these shares total 100%.

- If you are naming a minor as a primary beneficiary, include the guardian's name or a custodian under the Illinois Uniform Transfers to Minors Act.

- In Box 3, list your secondary beneficiary or beneficiaries with the same required information. Again, verify that the shares total 100%.

- Once all beneficiary details are completed, review the information you entered for accuracy. Initial any changes made to the form.

- Sign and date the form in Box 4. Remember, only the annuitant can sign this form.

- After completing the form, either save the changes, download a copy, print it, or share the form as needed.

Complete your IL IMRF 6.11A form online today to ensure your beneficiaries are appropriately designated.

A government pension refers to retirement benefits provided by federal, state, or local government organizations. Typically, these pensions are funded through taxpayer dollars and offer defined benefits based on salary and years of service. Understanding the framework of government pensions, including the IL IMRF 6.11A, can help you make better retirement plans and decisions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.